Renter's Insurance and Another Top-10 List -- States with the Most (and Least) Expensive Renters Insurance

An estimated 34.9 percent of U.S. households are renters (65.1 percent homeowners) according to the latest estimates from the U.S. Census Bureau as of Q4 2019. While the average net worth of homeowners is significantly greater than renters ($231,400 to $5,200) renters still have possessions at risk in their rental properties.

Renters Insurance costs vary due to location, claim history, amount of coverage and what items are specifically included and excluded from the policy. ValuePenguin (a subsidiary of LendingTree) focuses on financial aspects of consumers – including insurance. They do several studies – with one of the latest on the cost and usage of renters insurance.

Renters insurance is surprisingly affordable, costing an average $187 per year or $16 per month, according to ValuePenguin. The typical renters insurance policy covers personal property for theft and damage for up to $25,000 along with personal liability insurance up to $100,000. The standard deductible ranges from $500 to $1,000 with lower insurance rates corresponding to higher deductibles.

These costs, however, vary from location-to-location. As usual the TINSTAANREM axiom — There Is No Such Thing As A National Real Estate Market – is invoked. Nor is there such a thing as consistent and uniform costs and coverages in renters insurance across the country. Despite the relatively low cost, less than one-half (40 percent) of all renters currently opt to purchase renters insurance.

Added Liability Coverage limits costs little, with the average cost of increasing from $100,000 to $300,000 causing premiums to rise just 5 percent to 6 percent. Increasing Personal Property Coverage from $25,000 to $50,000 increases the respective premium from 20 to 80 percent. How the renter’s possessions are valued also impacts the cost of insurance. Policies based on Replacement Cost Value (the cost to buy a new one) costs much more than one Actual Cash Value (the current value of the insured). Safety features, such as burglar and fire alarms and dead bolts, may entitle a discount from the insurer.

Endorsements are available at a greater cost for higher-valued items such as jewelry, as these type of items are specifically excluded from the standard policy.

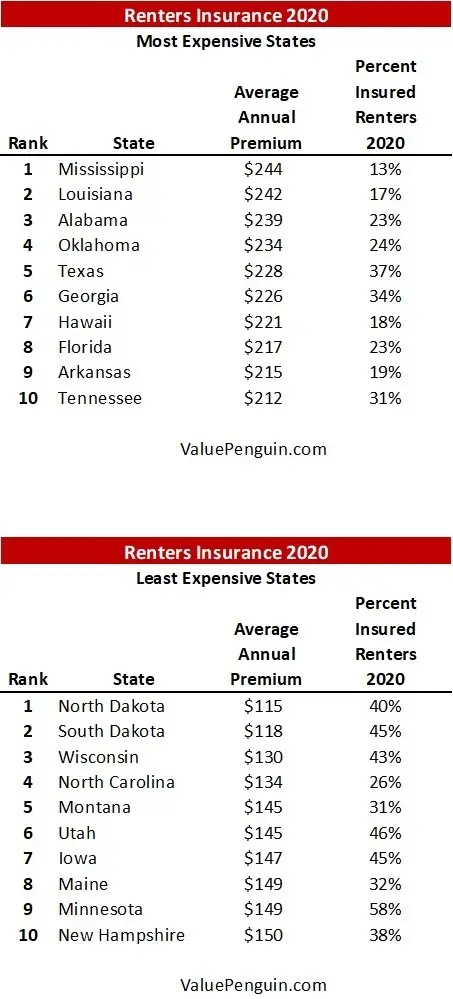

The following two tables show the states with the highest and lowest average annual cost of renters insurance. Included also is the estimated percentage of renters that are covered by insurance. The most expensive states tend to have a greater incidence of natural disasters.

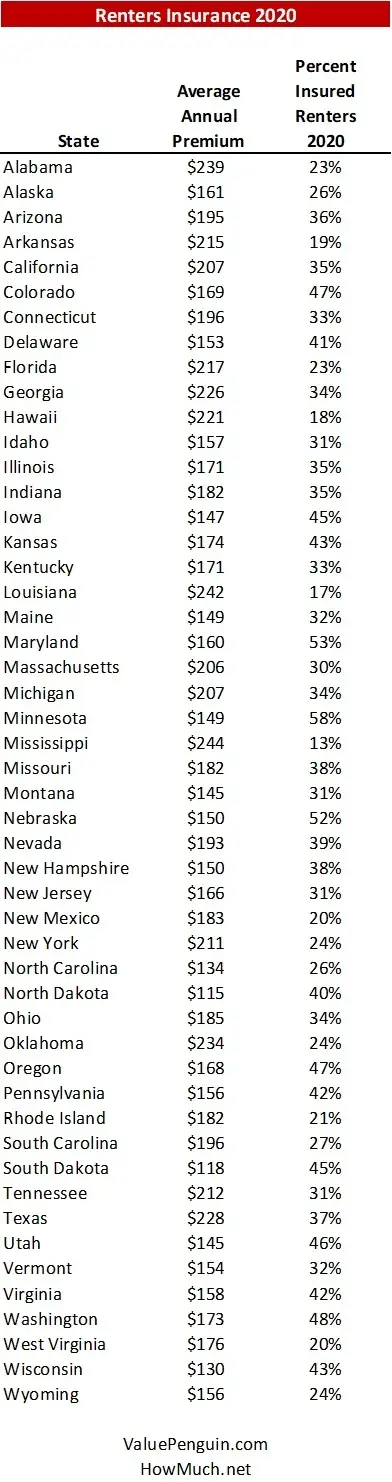

The next table shows these metrics alphabetically by state for the standard policy described above.

To read the article from ValuePenguin click https://www.valuepenguin.com/average-cost-renters-insurance

To view the graphic from HowMuch.net got to https://howmuch.net/articles/average-cost-renters-insurance-state

For a series of FAQs on renters insurance click https://www.valuepenguin.com/does-renters-insurance-cover-water-damage

The latest press release on homeownership rates from the Census Bureau can be read at https://www.census.gov/housing/hvs/files/currenthvspress.pdf

I carried renter’s insurance when going to graduate school and fortunately never had a claim, but did have ease of mind when it came to our possessions.

Ted