Potential High-Risk Housing Markets Due to Coronavirus

The economic impact of the Coronavirus varies from one city to the next just like medical symptoms and severity of those infected by the virus differs from one person to another. A myriad of factors affect how each local housing market will respond under these pressures and economic uncertainties. My favorite economic and real estate term is, “It’s all about jobs.” Jobs create effective demand for housing. While some jobs have persevered in the face of Coronavirus, more than 30 million jobs have disappeared – at least temporarily. As discussed in a blog yesterday, one out of every two Leisure & Hospitality jobs (46.8 percent) were lost in April 2020 alone. See

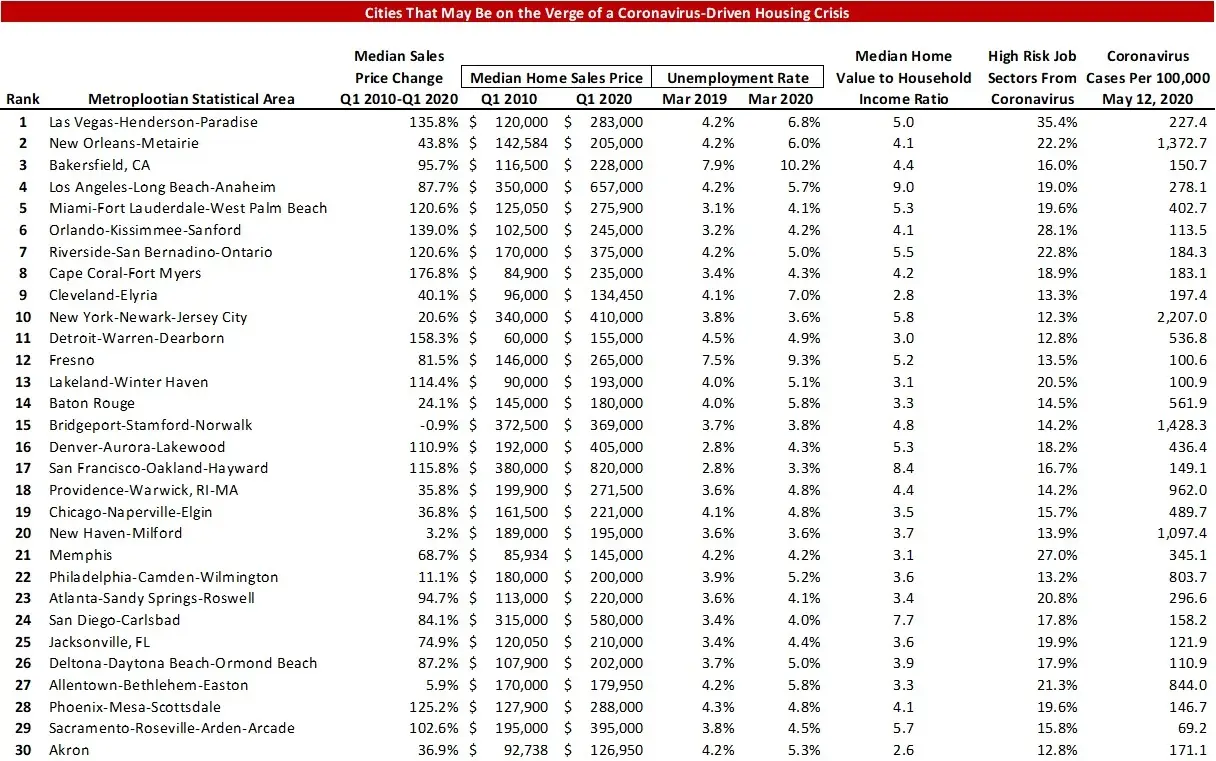

To estimate which housing markets face the most risk from Coronavirus, 24/7 Wall Street created an index, including metrics of the overall health of the respective housing market and local economy:

- Change in Median Home Sale Prices from Q1 2010 to Q1 2020, ATTOM Data Solutions – _full weight_

- Number of Distressed Sales in Q1 2020 including Real Estate Owned Sales, Short Sales and Foreclosure Auction Homes Sold to Third Parties, ATTOM Data Solutions – _half weight_

- Number of Seriously Underwater Residential Mortgages as a Percentage of all Outstanding Mortgages in Q1 2020 (loan-to-value ratios of 125 percent or more), ATTOM Data Solutions – _one-half weight_

- Number of Foreclosure Filings as a Percentage of All Housing Units as of Q2 2020, ATTOM Data Solutions – _half weight_

- Unemployment Rate, Seasonally Adjusted as of March 2020, Bureau of Labor Statistics (BLS) – _half weight_

- Percentage Point Change in the Unemployment Rate from March 2019 to March 2020, BLS – _full weight_

- Ratio of Median Home Value to Median Household Income from the U.S. Census Bureau’s American Community Survey 2018 as a proxy for affordability – _full weight_

- Percentage of Employment in High Risk Industries from BLS 2018 Quarterly Census of Employment and Wages and COVID-19 Industry Risk Analysis from the March 2020 paper, COVID-19: a Fiscal Stimulus Plan, published by Moody’s Analytics. Sectors most vulnerable include Oil & Gas, tourism and transportation

- Number of Confirmed COVID-19 Cases as of May 12, 2020 from respective state and local health departments, adjusted for population using five year data from the American Community Survey 2018 – _full weight_

Findings and select summary metrics are shown in the following table which ranks the 30-most-at-risk housing markets due to Coronavirus. There is no one stereotypical description for metros on the list. While there are many tourist destinations with high-numbers of Leisure & Hospitality jobs such as Las Vegas, New Orleans and Orlando, some others include manufacturing (Akron and Cleveland), regional service and agricultural centers (Fresno and Bakersfield), seasonal and permanent retirement destinations (the Florida metros and Phoenix-Mesa-Scottsdale) and even the largest Metropolitan Statistical Area in the Country – New York-Newark-Jersey City. There is no one-size fits all description among the top-30.Corona

To read the entire article printed in USA Today click

Ultimately, supply and demand will govern how these housing markets perform under the Coronavirus Pandemic. When it comes to the effective demand for real estate, jobs are everything. But 35 million (and counting) jobs just disappeared – hopefully temporarily.