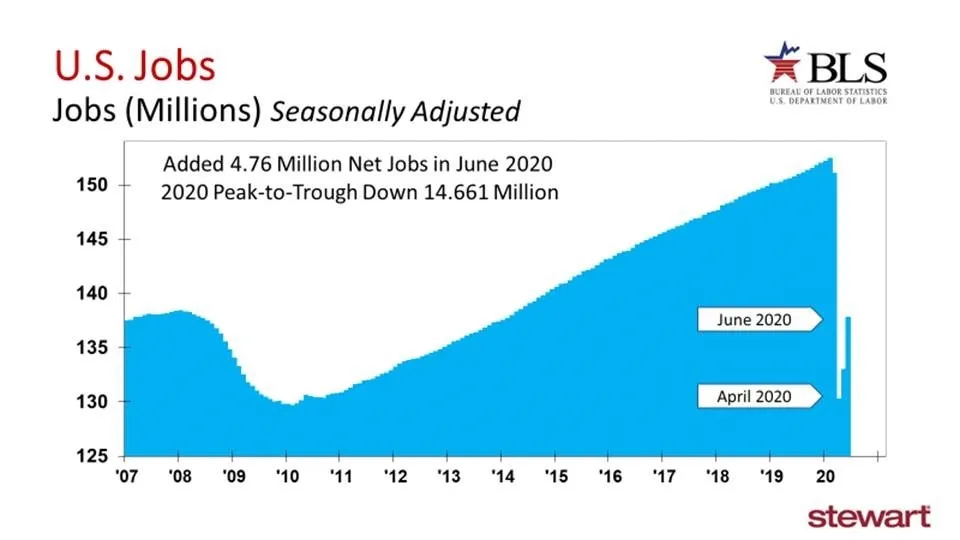

U.S. Added Back 4.76 Million Jobs in June 2020 - Largest Monthly Job Gains in History

The U.S. job market recovered 4.76 million jobs in June 2020 — the largest single monthly gain in history, according to the U.S. Bureau of Labor Statistics (BLS). This exceeded the consensus forecast of 3.7 million jobs from a survey of economists by MarketWatch. The unemployment rate improved to 11.1 percent in June from 13.3 percent in May. The graph above shows the total number of jobs in the U.S. on a seasonally adjusted basis. The country remains down 14.661 million jobs since the pre-Coronavirus peak in February 2020. For now, these data support the potential for a V-shaped recovery, though rising pandemic cases may limit progress.

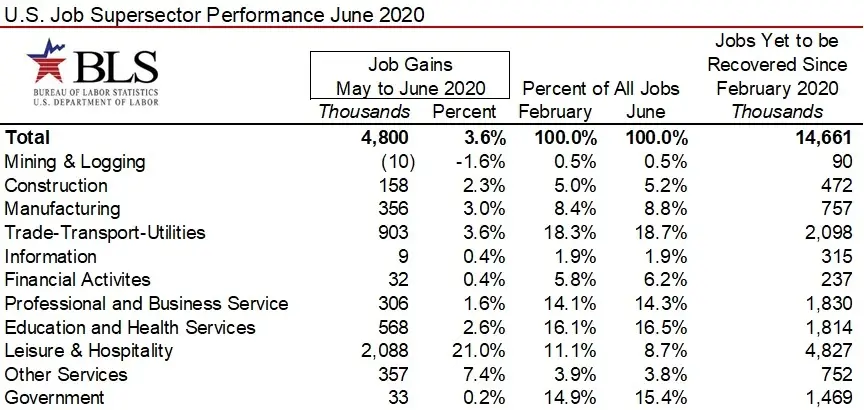

The following table shows the employment Supersectors as defined by the BLS. The first two columns detail job gains (in thousands and percentage change) from May to June 2020. Only one sector — Mining & Logging (which includes Oil & Gas) — showed a decline, shedding an additional 10,000 jobs in June. Though Leisure & Hospitality posted the largest gain, it also previously suffered the biggest loss, dropping one of every two jobs from March to April. The next two columns compare each Supersector’s total share of jobs between February (pre-Coronavirus) and June. The last column details the total number of jobs yet to be recovered since the February peak.

The massive losses in Leisure & Hospitality during March and April are shown in the next graph. The good news is the ongoing recovery — though there is still a long way to go.

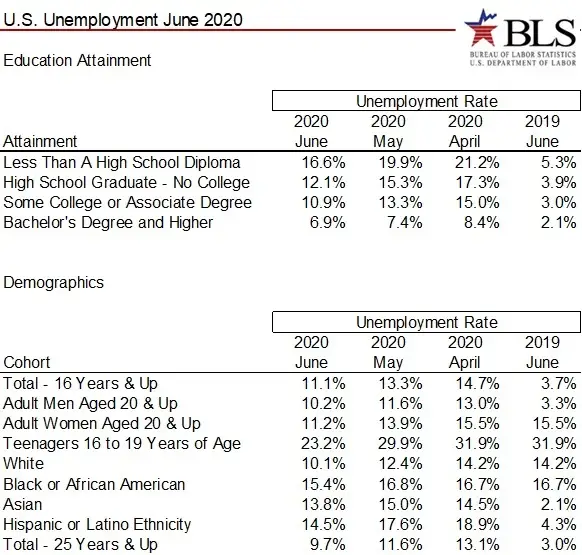

Unemployment improved across every demographic and educational attainment segment from May to June. The next table details unemployment rates for April, May, and June 2020, and for June 2019.

To download the latest BLS press release, visit www.bls.gov/news.release/pdf/empsit.pdf.

To review how the BLS compiles these estimates — and the weaknesses inherent in the process — see the prior Stewart Blog post: April 2020 Jobs Report – Ugliest in Our Lives with More to Come.

The Bureau of Labor Statistics (BLS) is the official keeper of employment data and uses two primary approaches to count jobs and track unemployment. The first is the Payroll Survey (used to estimate total jobs) and the second is the Household Survey (used to estimate unemployment).

Payroll Survey

This survey estimates the number of people employed, hours worked, and earnings for nonfarm workers, along with job type, industry, and geographic details. It is based on monthly polling of approximately 145,000 businesses and government organizations representing about 697,000 workers. Establishments report employment for the pay period that includes the 12th of the month — hence the potential for missing some job changes among workers with multiple pay periods each month. Roughly one-third of businesses have a weekly pay period, 40 percent biweekly, 20 percent semimonthly, and a small share monthly. This is also known as the Establishment Survey.

Household Survey

This survey estimates the total labor force, employment, and unemployment rates, as well as demographic details. It involves a monthly poll of roughly 60,000 households conducted either in person or by phone. No in-person interviews were completed in the past two months due to the virus. Individuals are classified as Employed, Unemployed, or Not in the Labor Force. In the most recent month, the response rate was around 70 percent — roughly 13 percent lower than the pre-virus norm.

To read more about the methodology of these two tools, visit BLS CES & CPS Trends Overview.

Unknown still is how much the rising Coronavirus case count will slow recovery. The economic cliffhanger continues.

Ted