Another Top-10 (Percent) List -- Best (and Worst) Cities for 1st-Time Homebuyers

The home remains the largest store of wealth for most households. Homebuying is a complicated process – particularly for unfamiliar first-time buyers. Still, first-time homebuyers represented one-in-three of all home sales (33 percent) according to the National Association of Realtor’s latest Annual Profile of Home Buyers and Sellers.

Some cities offer better opportunities than others for first-time buyers based on a myriad of factors. WalletHub.com examined data from the largest 300 cities in the country (where data were available) focusing on three primary sets of factors: Affordability, Real Estate Market, and Quality of Life. Within these three factors, 26 metrics were graded using a score where 100 represented the most favorable conditions for first-time homebuyers and zero the worst. The metrics along with respective weights employed are listed as follows. Data flagged with an asterisk * are at the statewide level only.

Affordability 33.3 Points

Housing Affordability 14.28 points

Average Cost of Homeowner’s Insurance * 4.76 points

Cost of Living 4.76 points

Cost per Square Foot 4.76 points

Real Estate Tax 4.76 points

Real Estate Market 33.3 points

Rent-to-Price Ration 4.44 points

Housing Market Health Index 2.22 points

Percent of Homes Sold in One Year 2.22 points

Median Home Price Appreciation 4.44 points

Percent of Mortgage Holders with Negative Equity 2.22 points

Buy vs Rent Breakeven Horizon 2.22 points

Percent of Listings with Price Cuts 2.22 points

Percent of Housing Units Built from 2010 to 2018 2.22 points

Building Permit Activity 2.22 points

Mortgage Lenders per Capita 2.22 points

Real Estate Agents per Capita 2.22 points

Millennial Homeownership Rate 2.22 points

Quality of Life 33.3 points

Coronavirus Support Score * 9.09 points based on Wallethub’s States Offering the Most Coronavirus Support Score

Weather 3.03 points

School System Quality * 3.03 points

Driver-Friendliness 3.03 points

Job Market 3.03 points

Total Home Energy Costs 3.03 points

Violent Crime Rate 3.03 points

Property Crime Rate 3.03 points

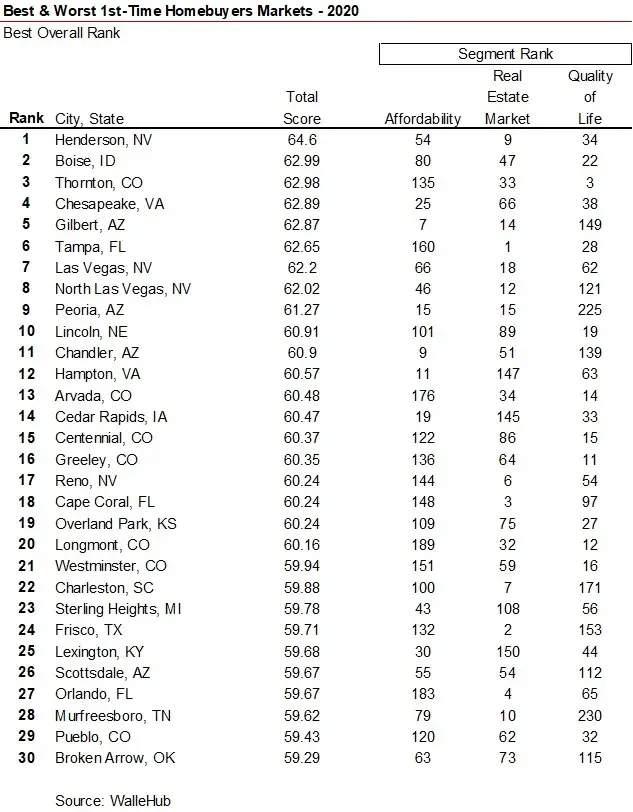

The cities are the individually incorporated locales and are subcomponents of larger Metropolitan Statistical Areas (MSAs). As an example, a few of the member cities of the San Francisco-Oakland-Hayward MSA include San Francisco (which ranked 299th overall), Oakland (295th), and Daly City (293rd). The first table shows the top-10 percent (best 30 of the 300 analyzed). Henderson, Nevada tops the list overall, and is a component of the Las Vegas-Henderson-Paradise MSA. Other member cities in the top-10 percent of best cities for 1st-time homebuyers include Las Vegas (7th overall), North Las Vegas (9th).

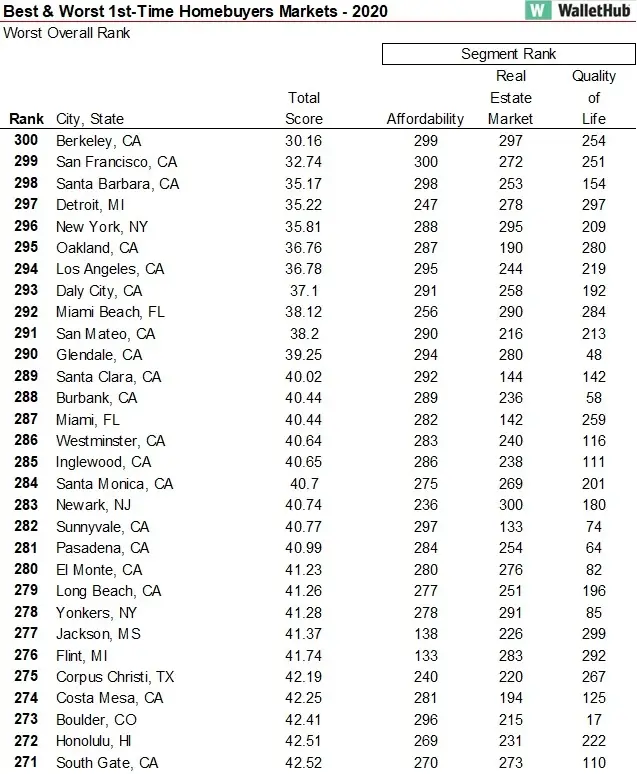

The next table listed the bottom overall-ranked 30 cities (10-percent). California cities dominate the bottom rankings, making up 19 of the worst 30-ranked cities.

The next table shows the 10-best and worst-ranked cities with respect to Affordability. All but two of the bottom 10-rankings based on affordability are located in California.

Rankings based on Local Real Estate Markets are shown next. New Jersey and New York each placed three locales in the bottom 10-city group based on local real estate markets.

The 10-best and 10-worst cities based on Quality of Life are shown in the next table. Eight of the 10-best cities for Quality of Life for 1st-time homebuyers are from Massachusetts. This was skewed by the Coronavirus Support Score metric which is statewide. Details on that study can be found at https://wallethub.com/edu/states-offering-the-most-coronavirus-support/73333/

Click here for a complete listing of all 300 ranks. To read the entire WalletHub study click https://wallethub.com/edu/best-and-worst-cities-for-first-time-home-buyers/5564/

Selection of included metrics and weightings both influence the outcome of these rankings. A material 9.1 percent of the total overall weight is assigned to the Coronavirus Support Score Metrics, three times that each of Violent Crime , Total Home Energy Costs or the Local Jobs Market. That metric skewed the results in favor of states with robust Coronavirus help and against those without. Changing the metrics and weightings will alter the outcome.

Despite headwinds from these factors, record-low interest rates are a rising-tide positive for all homebuyers – repeat and first-timers. Even better news is the latest forecast from Fannie Mae expecting 30-year fixed-rate, conventional mortgage interest rates to drop from an average 3.1 percent in 2020 to 2.7 percent average in 2021. Low rates are helping housing sustain the economic recovery from the pandemic.

Ted