Home Sales, Interest Rate and Lending Volume Forecasts for 2020 & 2021

Record-low interest rates continue to drive home sales and refinance lending volumes – perhaps two of the brightest spots of the U.S. economy today. Following is a summary of the September 2020 forecasts from Fannie Mae and the MBA for interest rates, existing and new-home sales and residential lending. Freddie Mac forecasts these also, but only on a quarterly basis. Fannie Mae and the MBA were more optimistic in their September forecast as home sales and lending surged.

Interest Rates

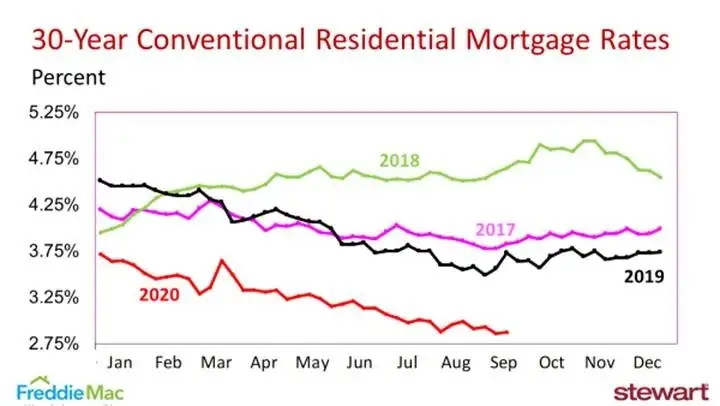

Conventional mortgage interest rates once again hit an all-time record-low 2.86 percent in the 2nd week of September as tracked by Freddie Mac in their weekly Primary Mortgage Market Survey. Weekly 30-year, fixed-rate conventional mortgage rates since 2017 are shown in the following graph.

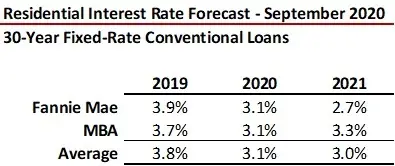

Expectations of rates for 2020 and 2021 were unchanged from the prior month and are shown in the table. While Fannie Mae and the MBA agree the average rate in 2020 will be 3.1 percent, they continue to diverge in 2021 with Fannie Mae forecasting a down tick to 2.7 percent and the MBA expecting rates to rise to 3.3 percent.

Existing Home Sales and Median Prices

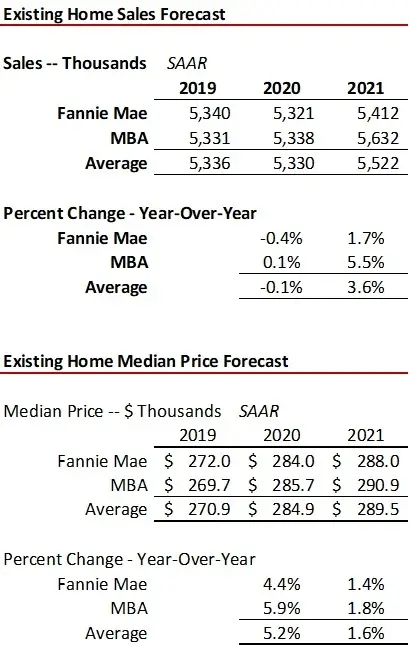

Fannie Mae and the MBA became more optimistic in their September forecast for existing home sales for 2020 and 2021. Fannie Mae changed from an expected 4.5 percent drop in their estimate in August to essentially flat (-0.4 percent) while the MBA moved from a 3.2 percent decline to no change. The MBA continues to more enthusiastic for home sales in 2021 with existing home sales at the 5.6 million level (up 5.5 percent year-over-year) and Fannie Mae up just 1.7 percent at the 5.4 million level. Average forecast increase in median values is 5.2 percent in 2020 and 1.6 percent in 2021.

New Home Sales and Median Prices

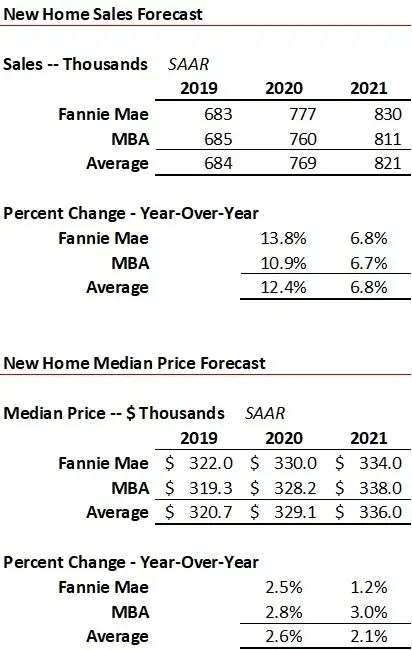

New home sales are forecast to be up from 10.9 percent in 2020 (MBA) to 13.6 percent (Fannie Mae). New home median prices are forecast to rise from 2.5 percent to 2.8 percent in 2020 and from 1.2 percent to 3.0 percent in 2021.

Residential Lending

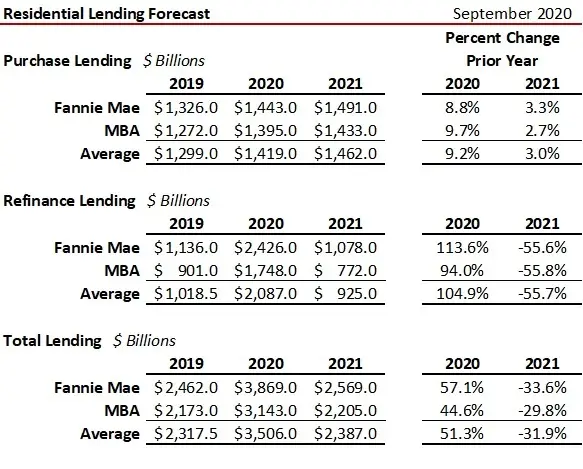

Fannie Mae is now forecasting an all-time record $3.87 trillion total residential lending volume in 2020, up from the prior record $3.76 trillion in 2003. While purchase lending is expected to rise 9.2 percent in 2020, refinance lending will double based on the average projection, with Fannie Mae showing a 113.6 percent surge compared to 2019 and MBA up 94.0 percent. Both show an estimated 56 percent drop in refinance lending volumes from 2020 to 2021.

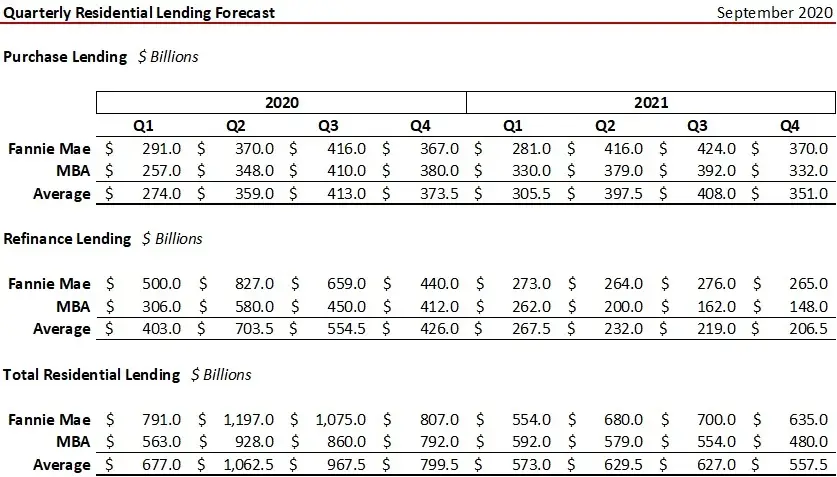

Quarterly lending volume estimates are shown in the following table, with percentage change from the prior year in the second table.

Jobs are everything to the economy and to home purchases. While low interest rates fuel refinance lending volumes, without a job and reasonable credit score, homeowners are unable to benefit. Thus far the high levels of home sales and refinance volumes would indicate that renters and not homeowners have shouldered the economic burden of housing arising from the pandemic. Unlike homeowners that have been protected by forbearance, renters have not been so fortunate. Yet to be seen is the impact of the expiration next year on evictions across renters and homeowners.