U.S. Retail Sales October 2020

Total retail sales are now once again strong, just like a faucet running at full flow. Depending on the type of goods being sold, however, the temperature of sales ranges from hot to cold.

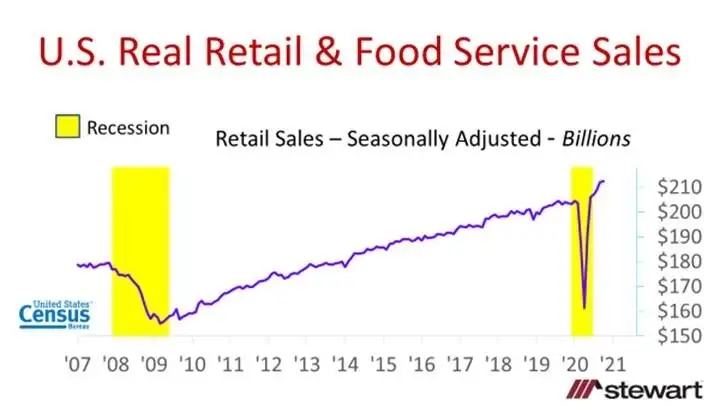

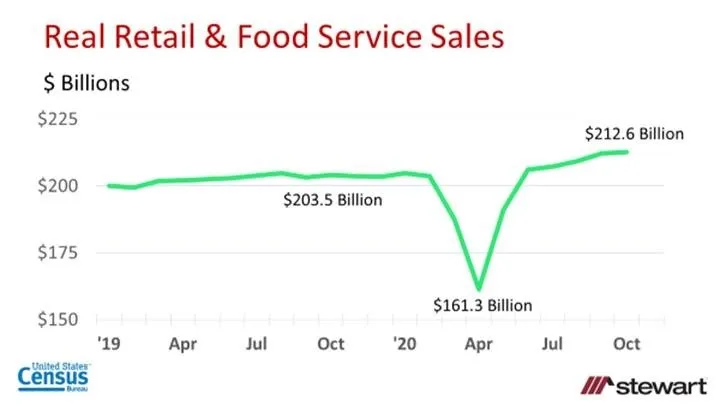

Total real (inflation adjusted) retail and food service sales were up 4.4 percent in October 2020 versus one-year ago, as shown in the following two graphs. Though each graph shows sales commencing January, the first starts in 2007 and the second in 2019.

E-commerce sales were already a growth trend prior to the pandemic, with that trend accelerating rapidly in Q2 2020 but shrinking some in Q3 as more stores opened up as governmental restrictions eased. E-commerce sales are shown quarterly in the following graph.

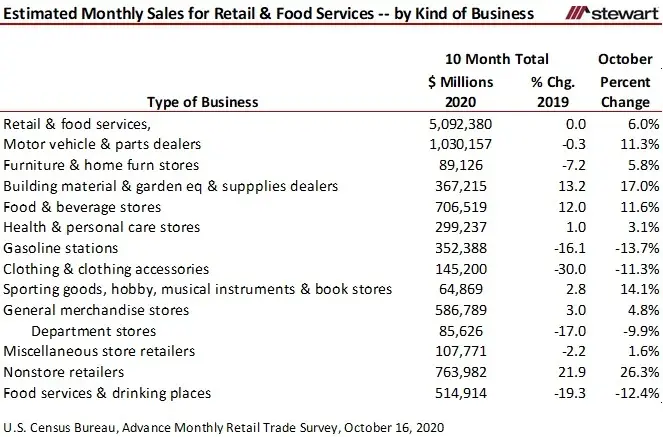

Though retail sales were up 4.4 percent after adjusting for inflation on a SAAR, what we are buying and where we buy is different. Advanced estimates of retail sales by Kind of Business are shown in the following table for both Year-to-Date and October. The U.S. Census Bureau bases these advanced estimates on early estimates using a small sample of firms – thus they are subject to revision and are not reported for every kind of business. Included businesses changes from month-to-month depending on data availability.

Largest gainers with more than a double-digits gain Year-to-Date

21.9% Nonstore Retailers -- where we buy

13.2% Building Materials & Garden Supply Dealers

12.0% Food & Beverage Stores

Largest sales declines Year-to-Date

-30.0% Clothing & Clothing Accessories

-19.3% Food Services & Drinking Places

-17.0% Department Stores

-16.1% Gasoline Stations

To see the monthly estimate of the Retail Sales from the U.S. Census click https://www.census.gov/retail/marts/historic_releases.html

Since it is Black Friday, there is probably not a better day of the year to talk about retail sales. Spend and drive the economy since retails sales typically make up 70 percent of GDP.

Ted