U.S. Jobs Report Nov 2020 - 12.3 Million Lost Jobs from Pandemic Recovered, 9.8 Million Yet to Go

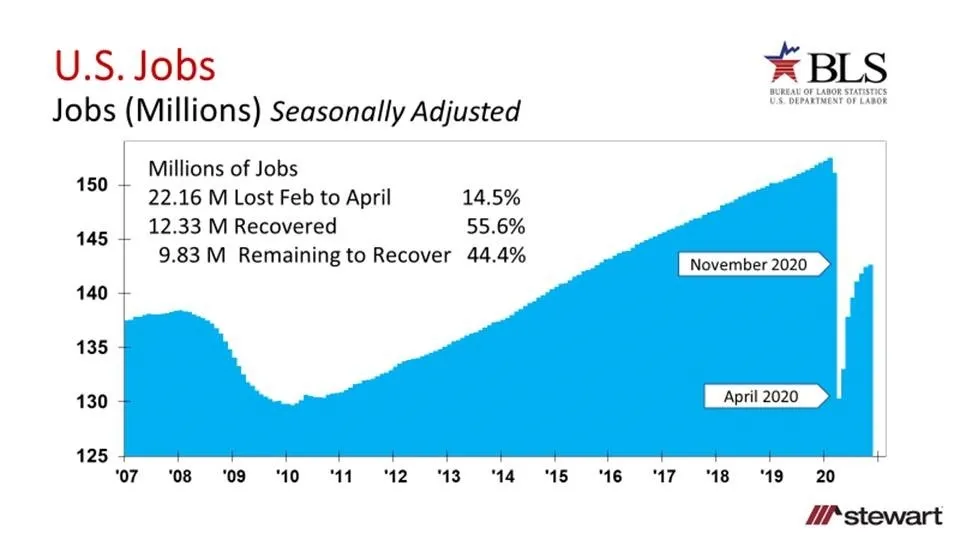

The U.S. added back 245,000 jobs in November 2020 — the lowest rate of monthly gain since the 22.2 million job plunge between March and April, according to the U.S. Bureau of Labor Statistics (BLS). However, the November gain marked the largest number of new jobs compared to pre-pandemic levels since May 2015. Unemployment slipped to 6.7 percent, down from 6.9 percent in October, after reaching a 14.7 percent peak in April. The chart below shows total U.S. jobs on a seasonally adjusted basis.

The 245,000 net job gain (preliminary) reported in November fell far short of the 432,000 consensus forecast among economists polled by MarketWatch. While Private Sector jobs rose by a stronger-than-expected 344,000, the Government Sector shed 99,000 jobs — at least temporarily. Although the Government Sector lost fewer jobs early in the pandemic (a 6.3 percent decline from February to the trough versus a 14.5 percent overall U.S. drop), it has since shed an additional 585,000 positions since August (2.7 percent of all government jobs). It remains the only sector posting a decline from October to November.

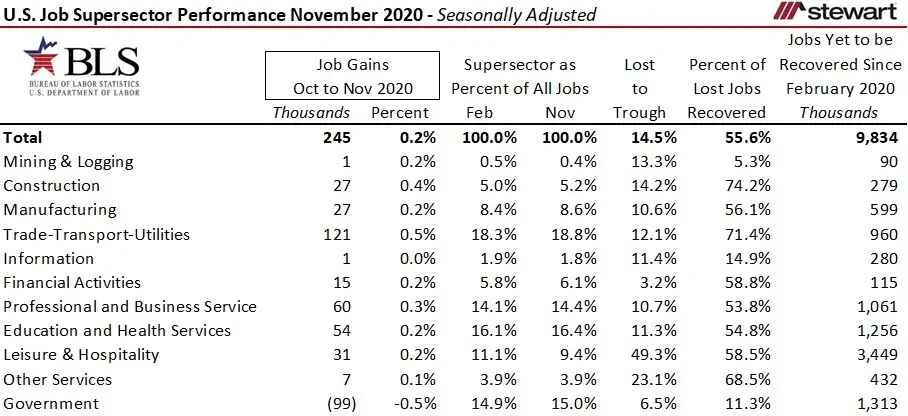

The following table shows job loss and recovery rates by SuperSector since February, which serves as the baseline prior to the pandemic.

Leisure & Hospitality jobs — which accounted for roughly one in nine jobs prior to the pandemic — were the hardest hit, falling by nearly half (49.3 percent). This sector remains a leading indicator of consumer confidence, as people typically do not travel, dine out, or book vacations unless they feel optimistic about the future. As shown in the following graph, though about half of the lost jobs have returned, the recovery has stalled in recent months. The ongoing debate about business travel centers not on when it will return to normal, but how much of it may be permanently gone. See my tweet on this topic at twitter.com/DrTCJ/status/1334177911050526723.

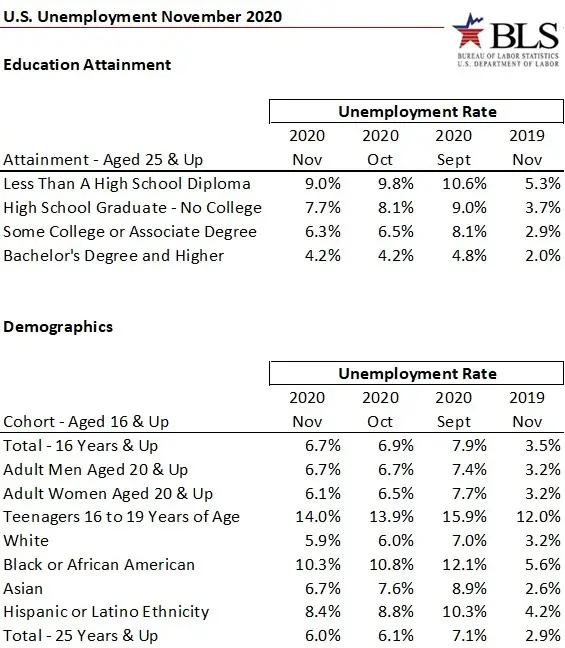

Unemployment rates also vary significantly across educational and demographic groups, as shown in the table below. The hardest hit remain younger workers, those with lower levels of education, and non-white populations.

To view the full range of employment-related data from the BLS, visit www.bls.gov and explore the Data Tools tab.

Despite the typical holiday-season uptick in employment, this year’s stay-at-home orders and surging COVID-19 rates point toward weak or even negative job growth through January. As Yogi Berra once said, “It ain’t over ’till it’s over.” Unfortunately, folks — this pandemic isn’t over yet. What a visionary you were, Yogi.

Ted