Housing Market, Residential Lending & Interest Rate Forecasts - December 2020

December 2020 monthly forecasts from Fannie Mae and the MBA show they continue to disagree on where home sales and residential lending volumes are trending for 2021. The divergence is a function of differing expectations regarding interest rates.

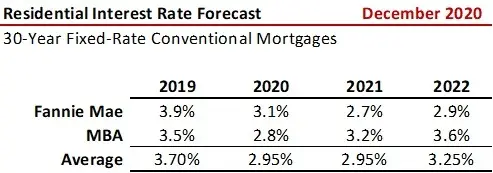

Interest Rates

Interest rates have a profound and material impact on housing affordability. The U.S. hit an all-time record-low residential mortgage rate at 2.66 percent for 30-year conventional fixed-rate loans for the week ending December 24th per Freddie Mac’s Primary Mortgage Market Survey. The average annual outlook for future rates from MBA and Fannie Mae are shown in the following table. While Fannie thinks rates will drop to 2.7 percent next year (average), the MBA forecasts rates to rise to 3.2 percent and then on up to 3.6 percent in 2022.

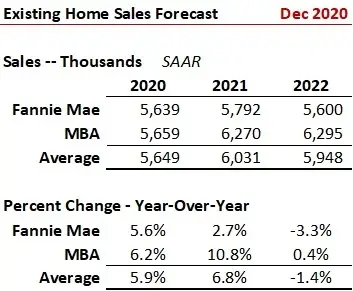

Existing Home Sales and Median Prices

Housing continues to be a key contributor to the ongoing -- but slowing -- U.S. economic recovery. Existing home sales through November 2020, as reported by the National Association of Realtors® (NAR), are shown in the graph, with the line representing total number of monthly sales on a trailing 12-month basis (TTM). The recovery in November from the plunge of sales in April now tops the pre-virus level. Existing home sales on a TTM basis are at the highest level seen since August 2007.

The forecast from Fannie Mae and the MBA for existing home sales for 2021 and 2022 are shown in the next table. While Fannie Mae expects home sales to increase 2.7 percent in 2021, the MBA prognosticates double-digit gains -- up 10.8 percent. MBA sees 2022 essentially flat with Fannie Mae estimating a 3.3 percent decline.

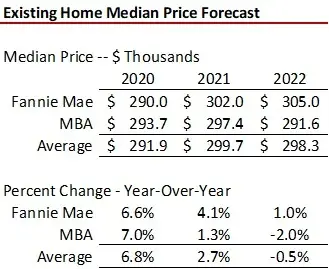

Median price forecasts also differ, with Fannie Mae seeing a greater median price gain in 2021 at 4.1 percent versus the MBA up a lesser 1.3 percent. MBA now forecasts a 2.0 percent median price dip in 2022 -- which is logical given their estimate of mortgage rates rising to 3.6 percent.

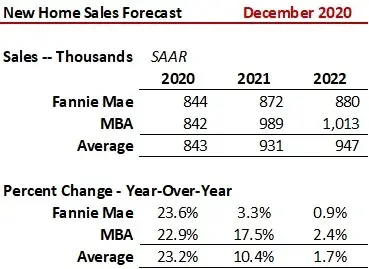

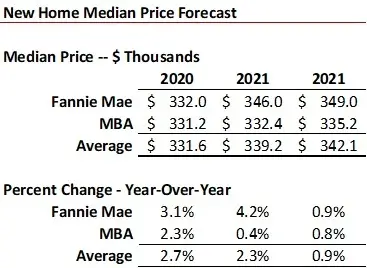

New Home Sales and Median Prices New home sales forecast is shown in the next table. Both Fannie and the MBA expect rising new home sales in 2021, though the MBA is significantly more optimistic at a 17.5 percent increase compared to Fannie Mae’s much smaller 3.3 percent. Each see a relatively constrained new-home market price increase in 2022 ranging from a minimal 0.9 percent blip at Fannie Mae versus the MBA’s 2.4 percent.

Identical to expectations for existing home price gains, Fannie Mae is prognosticating an even bigger 2021 increase in median new-home values, up 4.2 percent compared to a minimal 0.4 percent change rise by the MBA.

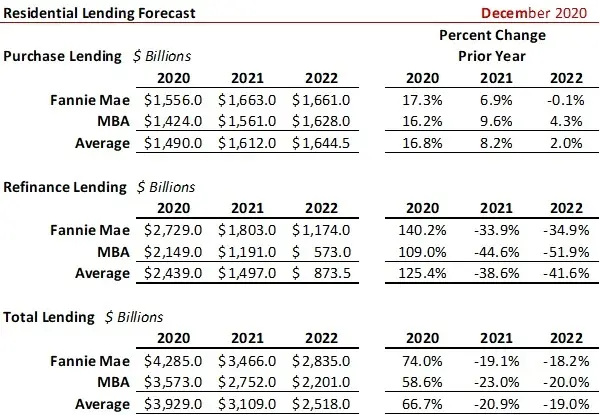

Residential Lending

After an all-time record level of residential lending in 2020, expectations call for a decline in total lending volumes in 2021 as interest rates elevate. Consistent with MBA’s higher interest rate forecast is a corresponding quicker drop in refinance lending in both 2021 and 2022 compared to Fannie Mae’s outlook.

Epilogue

Interest rates will drive housing values and refinance volumes, though uncertainty remains as to how quickly rates will change. Still, the 2021 and 2022 housing markets look pretty good darn good – at least at this point in time.