Existing Home Sales in 2020 Best Since 2006

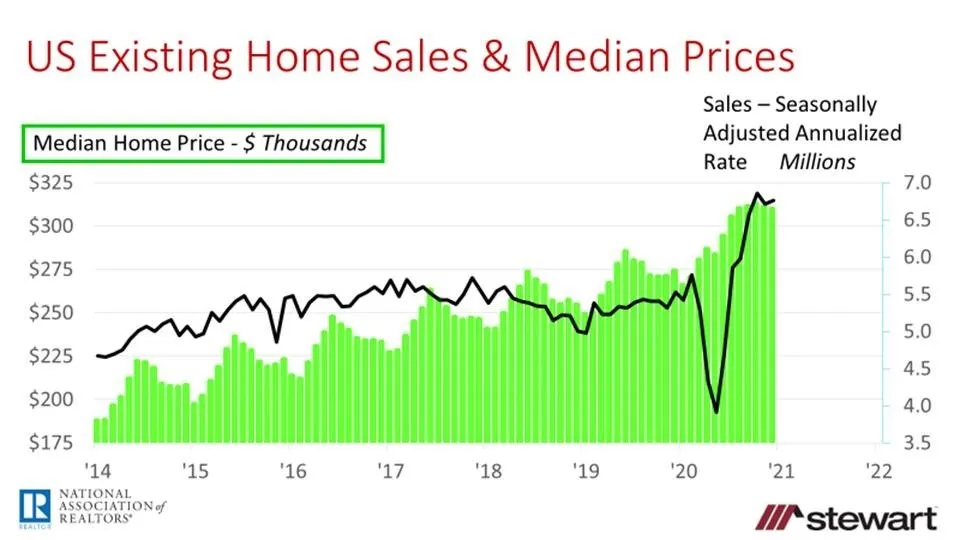

Existing home sales came in at 6.76 million in 2020 on a seasonally adjusted annualized rate (SAAR), the best performance seen since 2006 according to the National Association of Realtors® (NAR). Annual 2020 sales were up 22.2 percent on a SAAR, while the median price (not seasonally adjusted) for the year was up 9.0 percent to $296,500. December 2020 sales were up 23.7 percent year-over-year with the median price up 12.9 percent to $309,800.

Sales on a SAAR and monthly median price commencing 2014 are shown in the following graph.

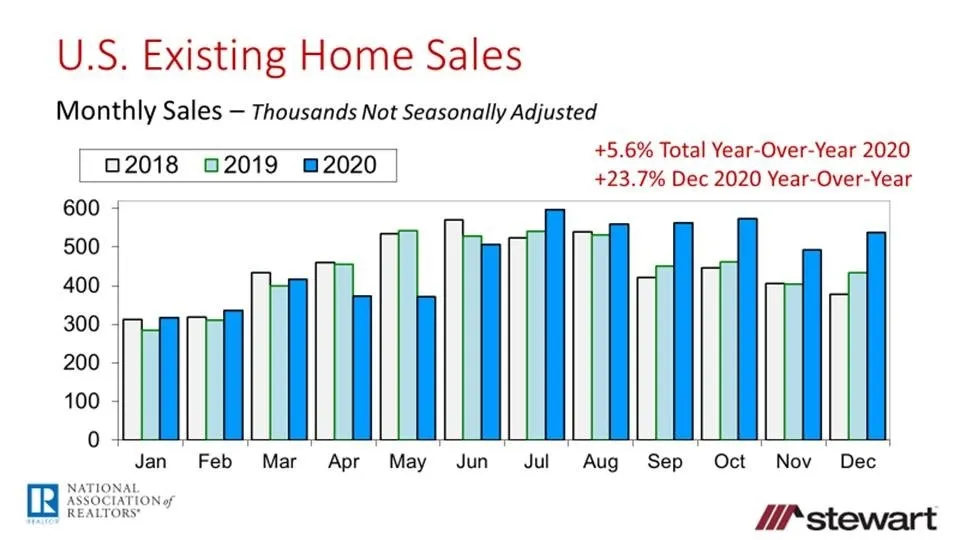

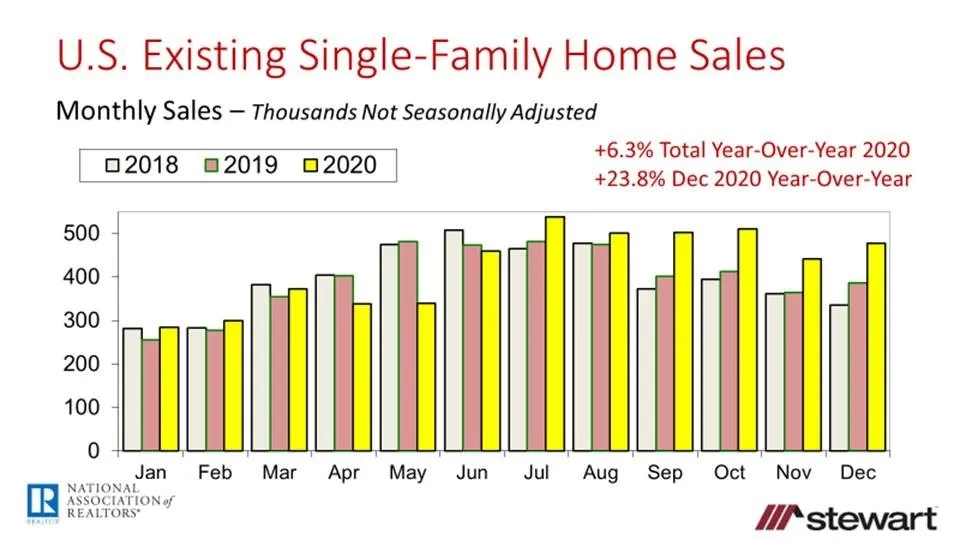

Using raw home sales data (not seasonally adjusted - actual closings), 2020 existing home sales rose to 5.64 million homes, up 6.3 percent. The following graphs show sales using the raw data as reported by NAR. The first graph shows sales on a trailing 12-month basis along with the monthly median price. The next three graphs depict monthly sales since starting 2018. Total home sales (single-family + condominiums + co-ops) were 5.6 percent in 2020, while single family rose 6.3 percent and condominiums + co-ops were essentially flat (down 0.3 percent).

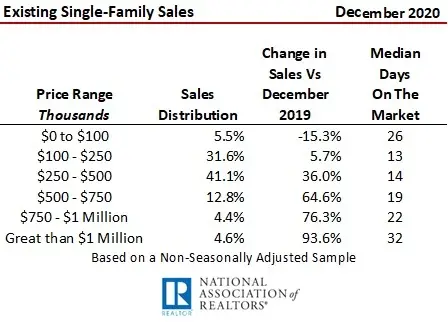

Higher-end housing sales ignited as the pandemic progressed. Single-family sales in December 2020 contrasted to the same month in 2019 are shown in the next table. Luxury goods sales typically decline during and immediately following a recession, but not this time. Where a person has lived today has had a greater impact on the quality of their life and life style than any period in 30 years as people have spent more time at home. As a result, higher-end housing demand and resulting sales have risen significantly as shown in the next table. This is based on a nationwide sample by NAR across single-family homes and is not seasonally adjusted. While total single-family sales were up 6.3 percent in December 2020, sales of $1 million and up almost doubled from a year ago – gaining 93.6 percent.

Other details in NAR’s press release included:

- Months inventory of homes available for sale dropped to 2.2 months on a seasonally adjusted basis – the lowest level seen since NAR commenced collecting listing inventory data in 1982

- There were just 1.07 million listings available for sales in December 2020, down from 23 percent from one-year ago

- Properties were on the market an average 21 days in December prior to receiving a signed and accepted purchase contract, one-half the period seen a year ago when it was 41 days

- 70 percent of all homes sold in December 2020 were on the market less than one month prior to an accepted offer

- 31 percent of December 2020 home sales were by first-time homebuyers

- Investors and second-home buyers acquired 14 percent of homes sold in December, down from 19 percent one-year ago

- All-cash purchases were made on one-in-five (19 percent) of homes sold in December 2020, essentially unchanged from 20 percent a year ago

- Distressed sales (short-sales and foreclosures) tallied less than 1 percent of December closings, less than one-half the 2 percent seen a year ago

To access the latest NAR housing sales press release click https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

Fannie Mae’s and the MBA’s outlook for existing home sales in 2021 call for increases of 3.7 percent and 10.2 percent, respectively. NAR’s chief economist is expecting a 9 percent gain in existing home sales while Realtor.com projects sales up 7 percent. I personally am in the flat to 5 percent gain range based on concerns of rising interest rates due to inflation.

Ted