Home Sales, Median Prices, Residential Lending Volume & Interest Rate Forecasts 2021-2022 -- Volume January 2021

In the list of uncertainties ranging from new tax rates and laws to the yet-to-be-known stimulus that will be passed by congress, add to that where home sales, median prices and lending volumes are heading. Once again, Fannie Mae and the MBA agreed to disagree in their respective monthly forecasts in January 2021.

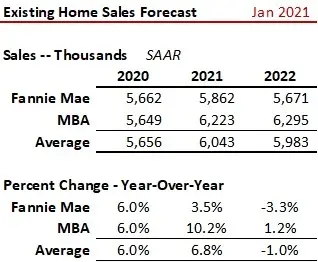

Existing Home Sales and Median Prices

Many were surprised by the strong pace of existing home sales in 2020, hitting a 14-year high as the pandemic made the intrinsic value of the home the highest in many individual’s lifetimes. Time spent at home since the pandemic was the greatest for most people in current generations. The first table shows the projections for existing home sales from Fannie Mae and Freddie Mac for 2021 and 2022. The 3.5 percent gain in existing home sales by Fannie Mae in 2021 is one-third the 10.2 percent gain expected by the MBA. Both see a drop from the 2021 pace in 2022, with Fannie Mae expecting a 3.3 percent decline and the MBA portending a dip to a 1.2 percent growth rate from the double digit gains seen in 2021.

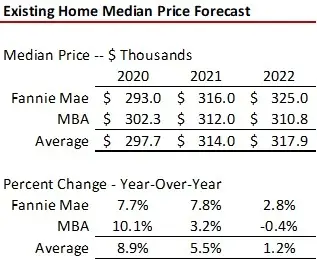

Median home price expectations are shown in the next table. Fannie is expecting double the rise in median home prices in 2021 compared to the MBA, coming in at 7.8 percent -- just one tenth of percentage point ahead of the 7.7 percent seen in 2020 – then up another 2.8 percent in 2022. The MBA, however, sees a muted 3.2 percent gain in 2021 following on the heals of 10.1 percent in 2020, then essentially flat in 2022.

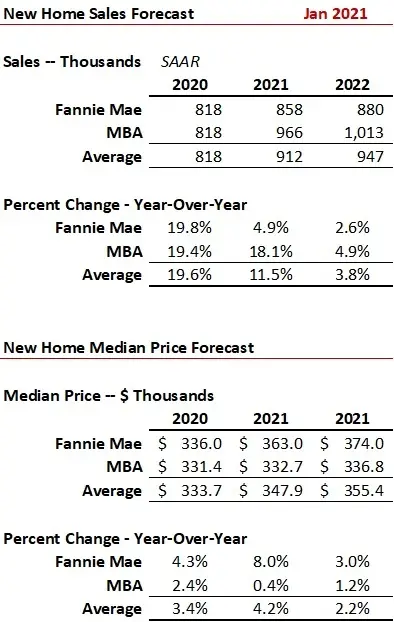

New Home Sales

Builders continue facing strong headwinds of rising lumber costs, tight labor markets, limited availability of appliances and materials and developed lot availability. The NAHB estimated that from April to September 2020, lumber costs increased by more than $16,000 for a single family home and $6,100 for a new multifamily unit. The forecast for new home sales and prices are shown in the tables. Just as with existing home sales, the MBA is more optimistic regarding the number of sales while Fannie is projecting stronger median new-home price growth.

Residential Mortgage Rates

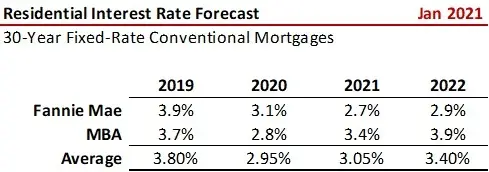

No doubt part of the divergences seen in new and existing home sales between Fannie Mae and the MBA can be attributed to differing views on where residential mortgage rates are heading. The next table shows the current forecasts. The MBA anticipates a 60 and 50 basis point increase in rates in 2021 and 2022, respectively. Fannie Mae is looking at 40 basis point decline in 2021 and a minimal 20 basis point gain in 2022.

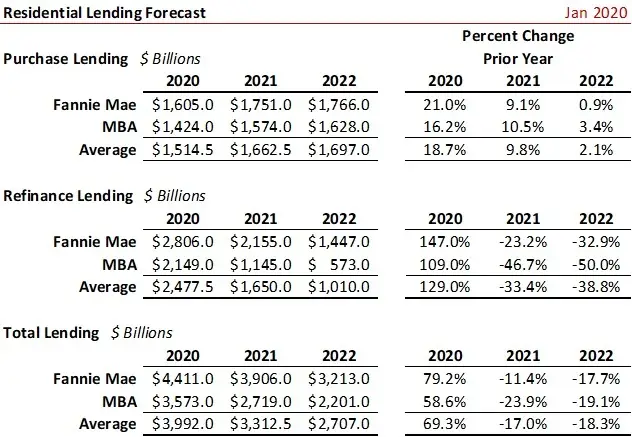

Residential Lending

Both Fannie Mae and the MBA expect rising total residential purchase lending volumes in both 2021 and 2022 -- though at differing rates. Total lending is a function of price and the volume of sales. They also agree on shrinking refinance lending – but diverge on how quickly the refinance tranche dissipates and the total amount of refinance lending last year. Fannie Mae, however, sees total lending of $3.906 trillion in 2021, which if realized would make it the second largest residential lending year in history, trailing only the $4.411 trillion in 2020. Prior to 2020, the residential lending peak was $3.76 trillion in 2003.

The disagreement in the forecasts between Fannie Mae and the MBA shows the substantial levels of uncertainty, never-before-seen-in-our-generation prior to the pandemic. Given the list of uncertainties including but not limited to the potential stimulus, actions of the Fed and Treasury in supporting the economy, when the pandemic becomes a historical statement – and even tax rates and laws, either of these forecasters could be correct.

As economists say, “Forecasting is difficult. Especially the future.”

Ted