Tale of Two Cities -- The Varying Economic Impact of the Pandemic

Who knew when reading Charles Dickens’s Tale of Two Cities in high school or college that parts of this classic text were prophetic regarding the impact of the 2020 COVID pandemic? Just as with the Tale of Two Cities, some people are better off (economically speaking) while others are financially devasted.

“It was the best of times, it was the worst of times, It was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity. It was the season of Light, it was the season of Darkness. It was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way….” The opening lines of A Tale of Two Cities, by Charles Dickens

The U.S. lost more than 22.3 million jobs at the onset of the pandemic in March and April 2020, the greatest two-month job decline in history and has yet to recover more than 9.8 million lost incomes. Not every household, however, felt the economic pain of this historic economic and medical catastrophe. Unemployment, though down from a massive 14.8 percent in April, fell to 6.3 percent in January. While good news, compared to the 3.5 percent seen in February 2020, the current 6.3 percent level is almost double the pre-pandemic level. The negative economic impacts of the pandemic are dismal – and these do not include the human and personal toll of the virus and related deaths:

- 10.1 million workers still unemployed

- $70+ billion of unpaid rent from just 2020 – and that will likely double by September 2021

- 5.3 percent of all home mortgage loans are in forbearance programs – of which many are now expiring and coming due

- As of December 2020, 2.1 million Americans had pulled money from their retirement plans across the five largest 401(k) plan administrators: Fidelity-Empower Retirement-Vanguard-Alright Solutions-Principal. Some households had to completely drain their retirement accounts just to survive. Vanguard reported that between March and September last year, just less than 5 percent of the 401(k) investors had taken a COVID-related withdrawal with the median amount of $12,000

- CNBC reported last September that by the end of 2020, 61 percent of households surveyed said their emergency accounts would not last through year-end or had already been depleted. Just 18.1 percent said they would not run out of emergency savings

While more than 10-million people remain unemployed, those that did not lose their jobs or hours worked fared comparatively well. This is evidenced by numerous metrics:

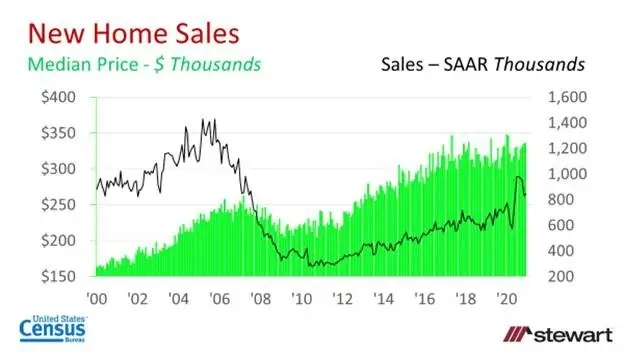

- Housing sales rose for both existing and new homes. Existing home sales were up 6.3 percent on actual monthly sales in 2020 as reported by the National Association of Realtors®, the best volume seen since 2006. New home sales rose 18.8 percent in 2020 compared to the prior year according to the U.S. Census Bureau, also the best since 2006. People that have lost their jobs do not buy homes

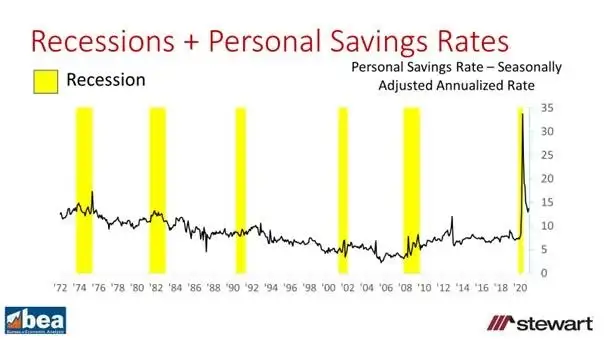

- The U.S. Savings Rate rose to the highest level in history peaking at 33.7 percent on an annualized basis in April 2020. Those that did not lose their jobs had fewer options to spend their money, thus savings among this group boomed. The current 13.7 percent savings rate posted in December 2020 was the largest seen prior to the pandemic since 1975 – 45 years ago. People that have lost their jobs withdraw money from savings rather than add to them

- Refinance lending volumes hit an all-time record in 2020, coming in at an estimated $2.806 trillion per Fannie Mae. Going forward in 2021, Fannie Mae expects the third greatest level of refinance activity on record exceeded only by 2020 and 2003. People that have lost their jobs or had their hours cut typically cannot qualify to refinance their home loans

- Purchase lending hit an all-time record $1.751 trillion in 2020, and is forecast by Fannie Mae to rise further to $1.766 trillion in 2021. People that have lost their jobs or had their hours cut typically cannot qualify to purchase a home using a loan

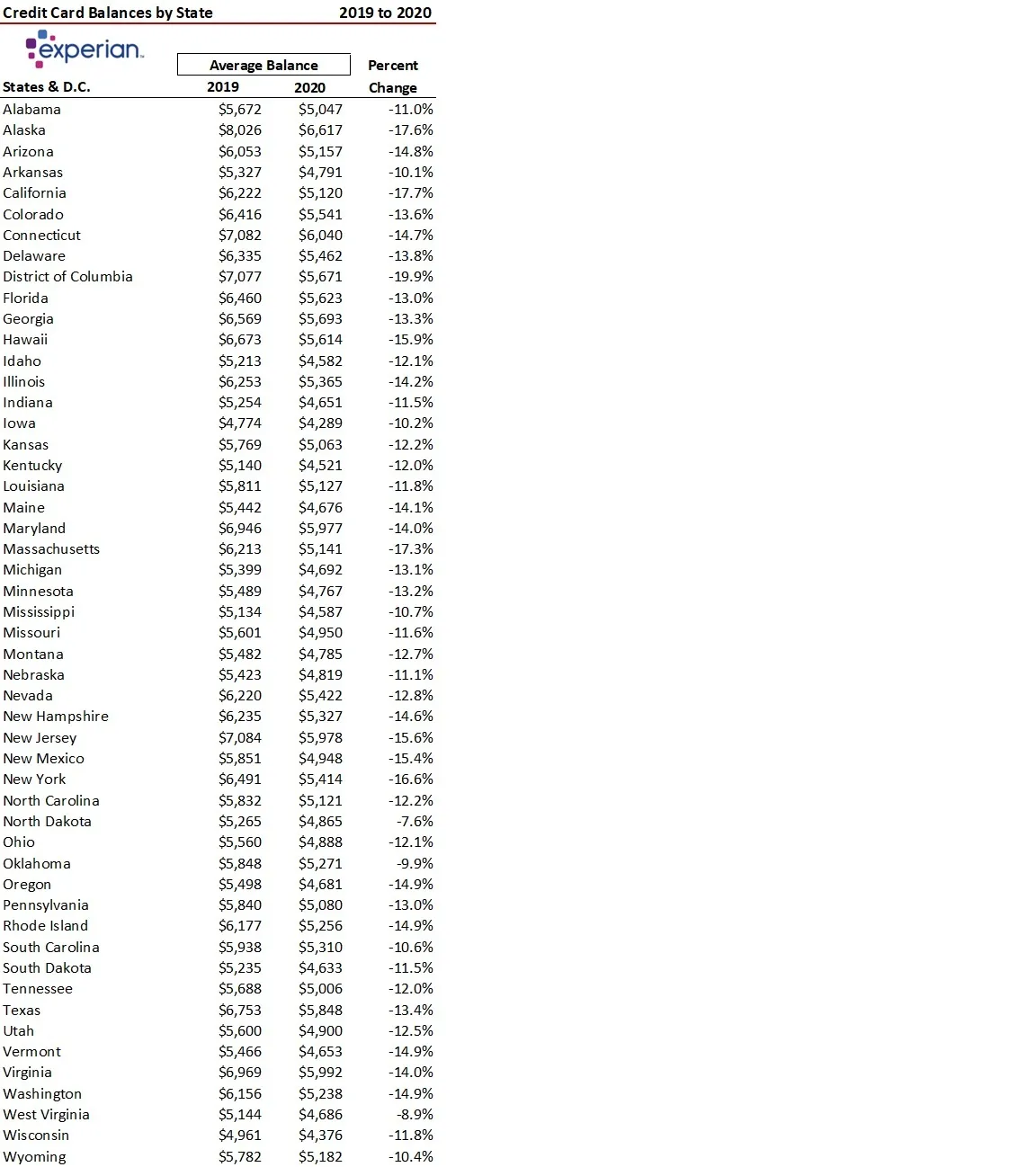

- Average credit card balances dropped in every state and the District of Columbia from 2019 to 2020 and across all age cohorts according to Experian. The average credit card debt in Washington, D.C. dropped by 19.9 percent from 2019 to 2020, with California having the second greatest decline at 17.7 percent, Alaska down 17.6 percent, Massachusetts dipping 17.3 percent and New York off 16.6 percent. Only three states had credit card balance drops of less than 10 percent: North Dakota -7.6 percent, West Virginia -8.9 percent and Oklahoma -9.99 percent.

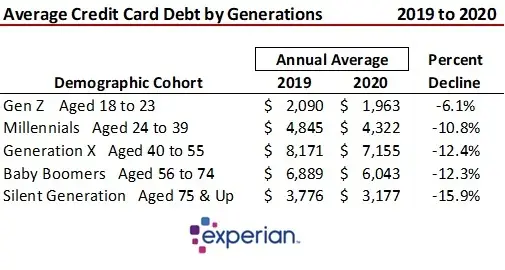

Within population cohorts, the drop in year-long average credit balances from 2019 to 2020 was in double digits for all groups except in Gen Z with a 6.1 percent decline. People that have lost their jobs or had their hours cut typically have increasing credit card balances or maxed-out credit

The comparisons from the most economically devastated to the those that gained economically are dramatic. It also shows the obvious disagreement regarding the next stimulus. No doubt, while millions of households and businesses are on the brink, others have enhanced economic foundations than prior to Coronavirus. For some their glass is overflowing, others one-half full, and, unfortunately, for those that have lost their jobs the glass is empty or shattered.

The Tale of Two Cities continues to be a prophetic work.

Ted