MSA Existing Home Price Gains on Full-Throttle in Q4 2020

Annual U.S. quarterly median prices for existing home sales peaked in the fourth quarter just twice in the past 20-years: 2002 and 2020. In both years, macro events drove the Q4 median price peak anomaly. The first in 2002 was following the atrocity of 911 and 2020 due to the pandemic.

Price peaks in the fourth quarter of 2020 permeated the country, according to an analysis of the latest release of median home data across the Metropolitan Statistical Areas (MSAs) by the National Association of Realtors® (NAR). More than one-half (53.6 percent) of the 183 MSAs tracked and reported by NAR posted the peak annual price in Q4 2020, compared to 18.6 percent, 14.2 percent and 19.1 percent for 2019, 1018 and 2017, respectively.

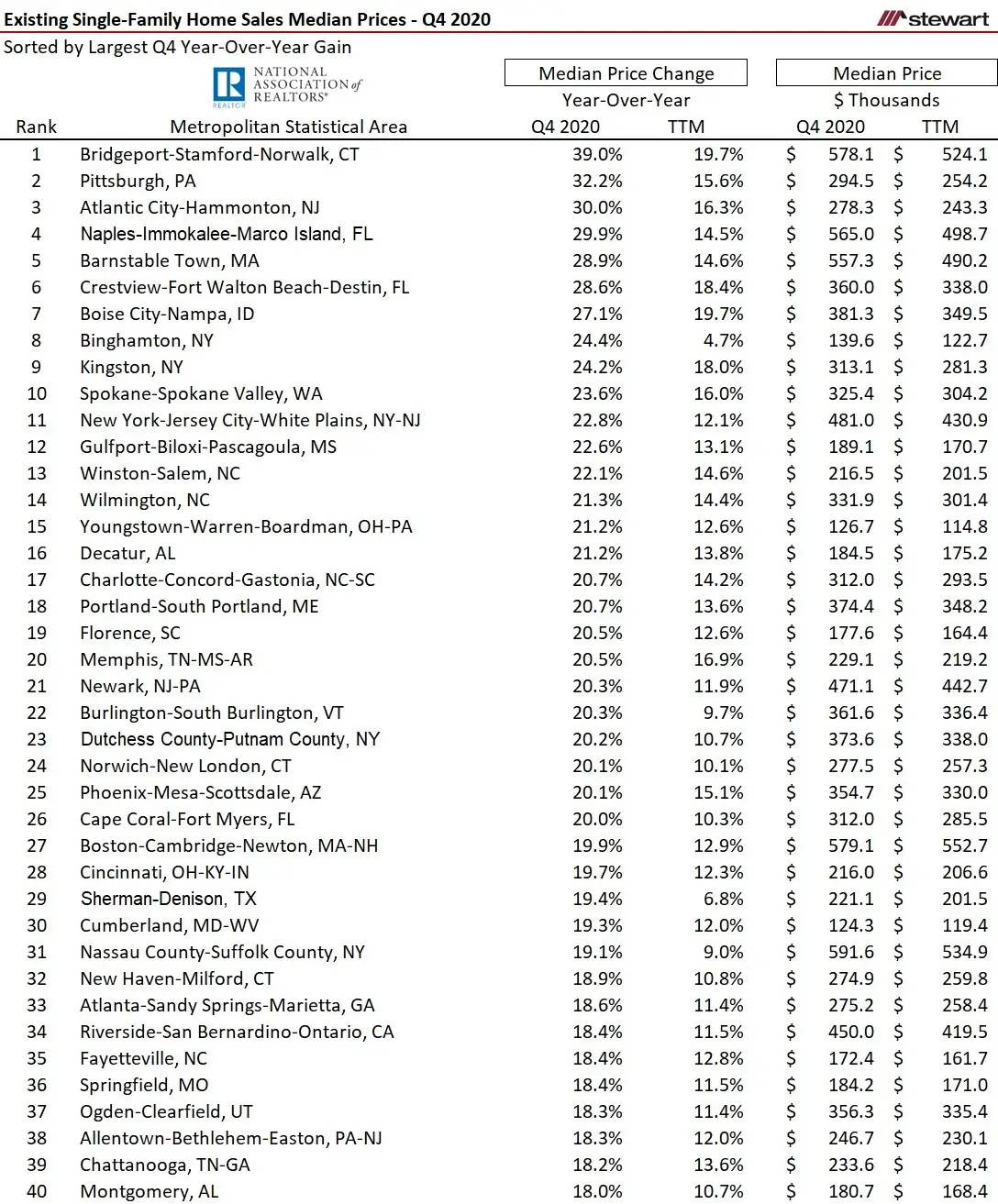

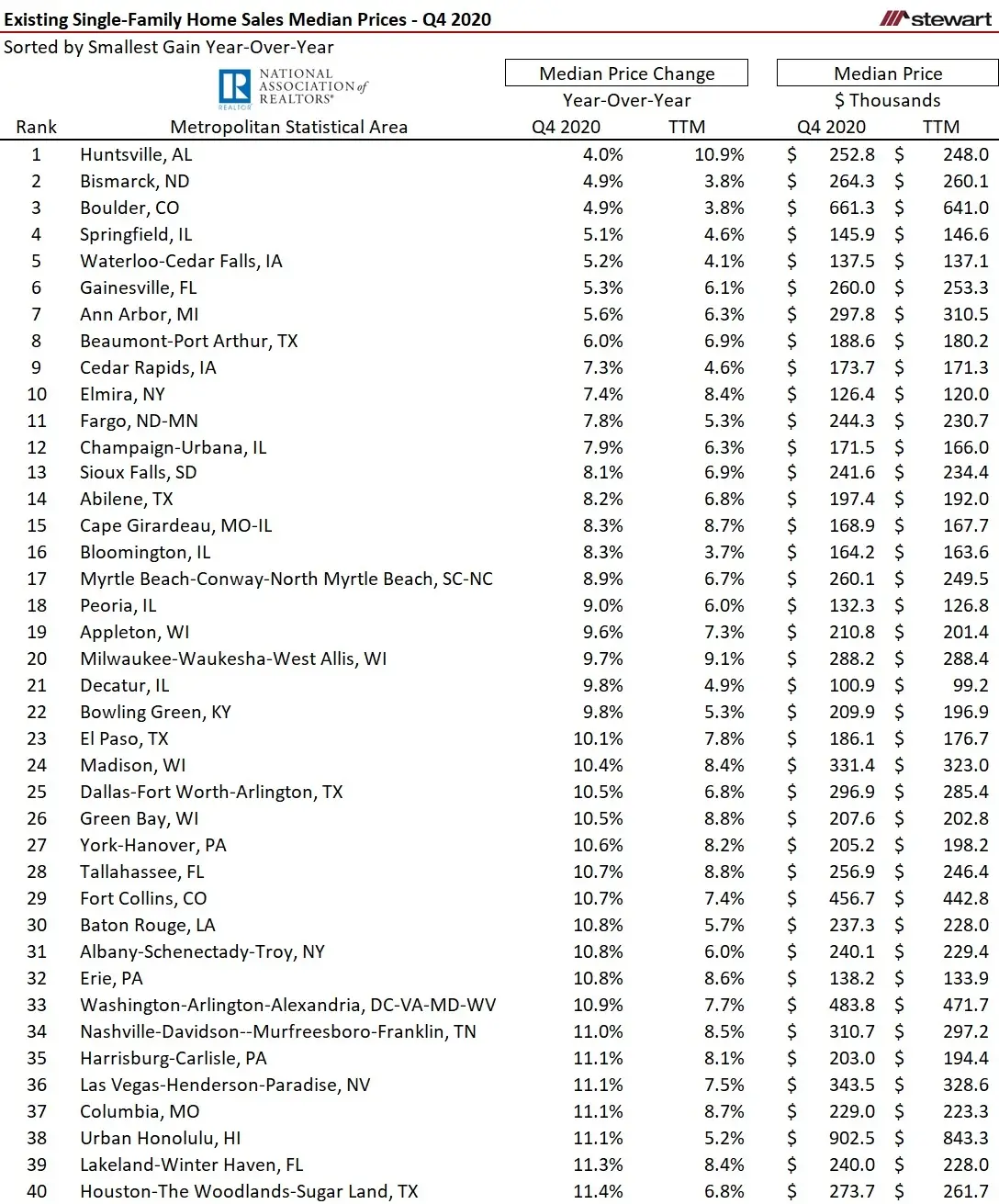

Not one single MSA posted a decline in median home price from Q4 2019 to Q4 2020. The following two tables show the 40 MSAs posting the greatest and least year-over-year median price gain.

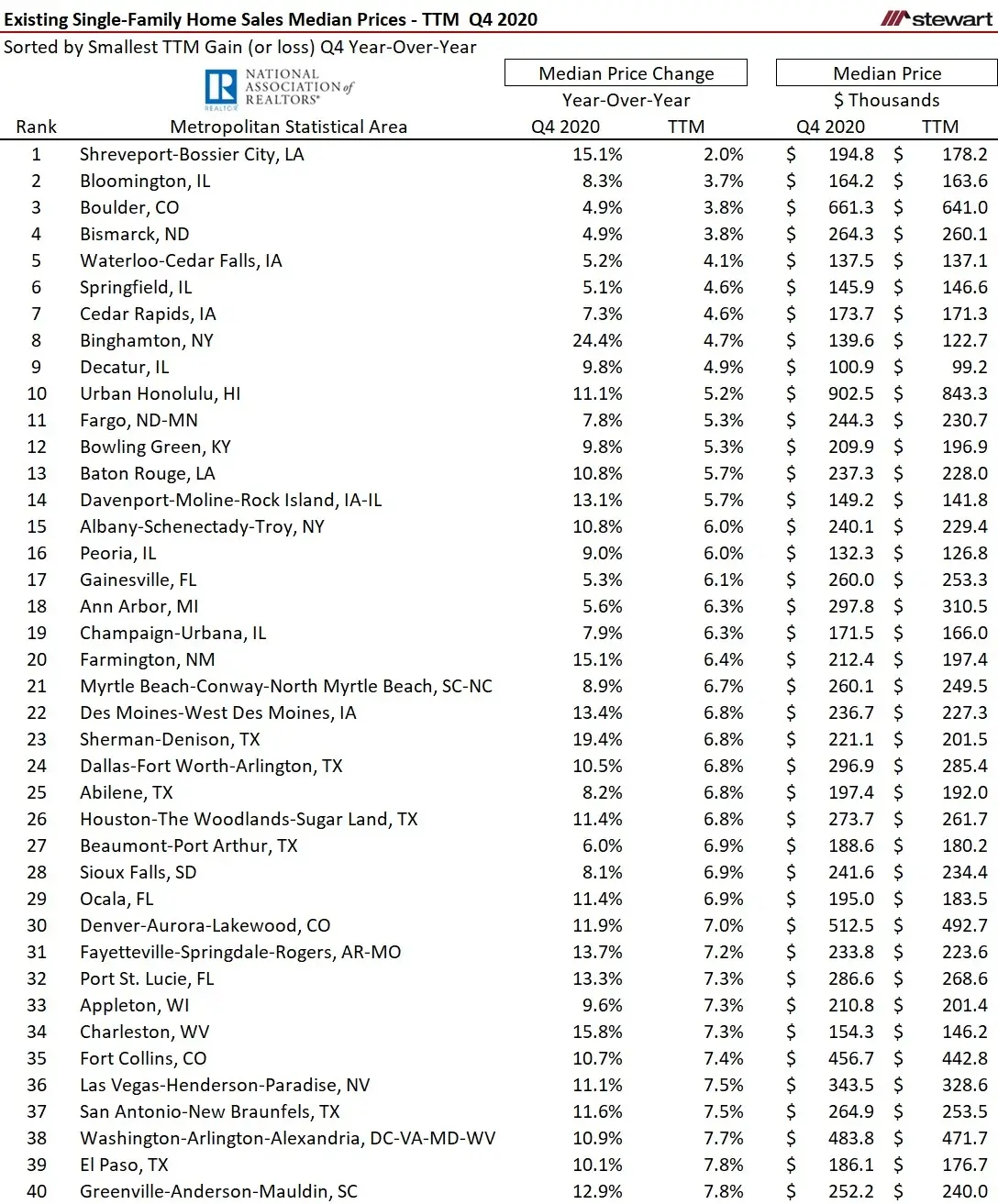

The next two tables look at the 40 MSAs each with the greatest and least changes in median prices on a trailing-12-month (TTM) basis. While some MSAs produced a single one-shot peak, these show longer-term growth perspectives. Every MSA posted a gain on a TTM basis.

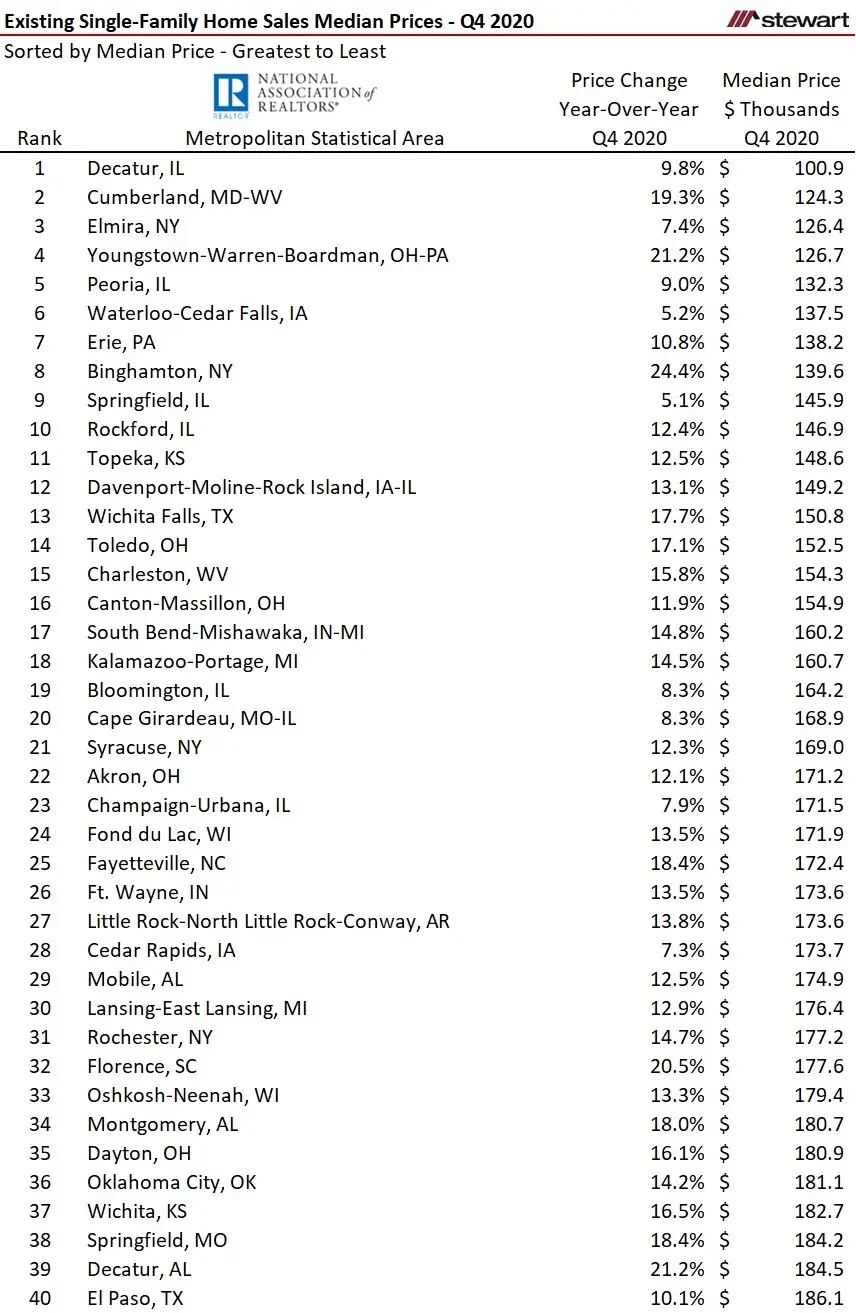

The final two tables show the 40 MSAs each with the greatest and least median existing home prices as of Q4 2020.

Click here for a PDF showing these metrics for the 183 MSAs with median price data reported by NAR.

To access the latest MSA median price series from NAR click https://cdn.nar.realtor/sites/default/files/documents/metro-home-prices-q4-2020-single-family-2021-02-11.pdf

To view the rich housing data available from NAR click https://www.nar.realtor/research-and-statistics/housing-statistics

Home sales numbers and home price gains finished 2020 on full throttle. With people spending more time in the lifetimes at home since the onset of the pandemic, the home continues to be at a pinnacle of intrinsic value. As more become vaccinated and herd immunity expands, intrinsic value will likely erode. Rising interest rates, however, may more impact home-price changes as 2021 progresses.

Ted