Interest Rates, Home Sales & Lending Forecast -- April 2021

In the dark and clouds, airplane pilots need to know where they are heading. Fortunately flight instruments lead the way. The same is true in residential markets with monthly updated forecasts by Fannie Mae and the MBA so market professionals do not have to fly blind across the economic landscape.

Each month Fannie Mae and the MBA update an array of economic and housing metrics. The following summary tables are from their latest April 2021 forecasts.

Just like a compass for pilots, interest rates are the initial directional indicator of home sales and lending volumes. Unlike the magnetic north where compasses always point, there is divergence in expectations between Fannie Mae and the MBA as shown in the table below. Though the latest forecast from Freddie Mac is also included, it is updated just quarterly rather than monthly. Fannie Mae and the MBA see rates rising just slightly this year while the MBA gauges rates jumping 80 basis points from 2020 and another 60 basis points in 2022.

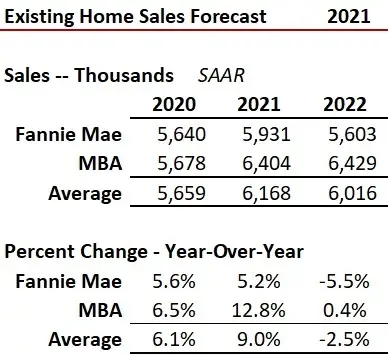

The flight plan for existing home sales are shown in the next table. Home sales are expected to continue on autopilot in 2021, but the target altitude differs, with Fannie Mae looking at a 5.2 percent gain and the MBA at a loftier12.8 percent. While the MBA expects that same ceiling in 2022, Fannie sees a drop of 5.5 percent even though their interest rate compass shows a lower expectation in 2022.

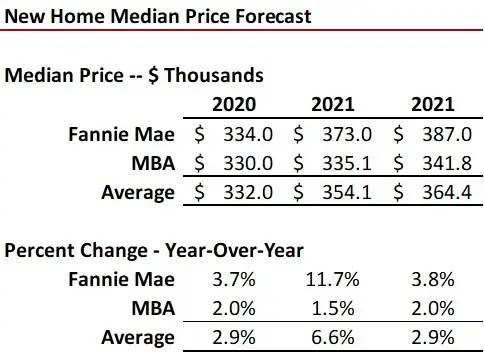

Median price expectations also vary, but reversed from home sales changes between the two forecasters. Logically, since Fannie Mae sees lower future interest rates, their expectation is for greater home price appreciation, up 11.5 percent in 2021 versus 3.1 percent by the MBA. Both see moderated price gains in 2022.

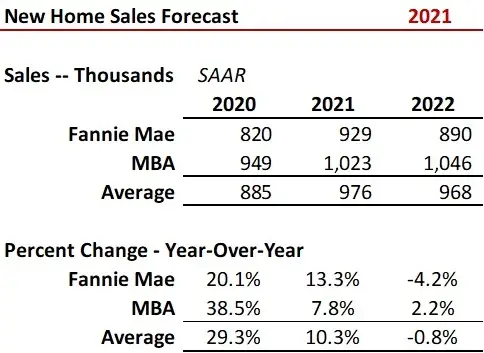

Just as each aircraft has a flight ceiling that is constrained by the design and propulsion of the specific airframe, new home builders see similar restrictions including materials availability, lack of skilled workers and rising costs of materials. Since April 2020, the spot price for jet fuel in the U.S. jumped 162 percent. Softwood lumber costs necessary to frame a typical new home also rocketed up more than $30,000. The new home sales forecast for both volume and median price are shown is the next two tables.

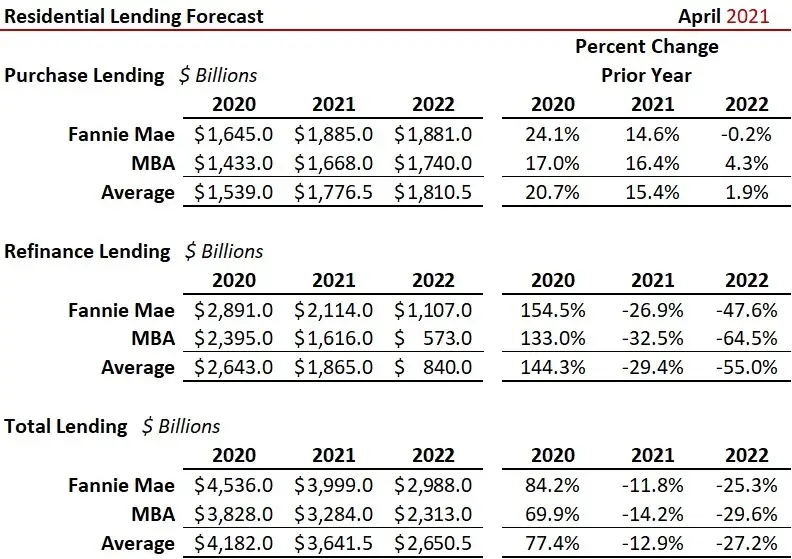

Total lending volumes will drop due to shrinking refinance activity as rates eventually gain altitude. Purchase lending (a function of price and sales volume akin to altitude and airspeed) has a positive outlook for 2021, but with growth slowing in 2022. The average forecast for refinance volumes for Fannie Mae and the MBA in 2021 is down 29.4 percent and then off another 55 percent next year. Massive.

To access the forecasts from Fannie Mae and the MBA click the following:

Fannie Mae https://www.fanniemae.com/research-and-insights/forecast/forecast-monthly-archive

While housing sales continue to benefit from a strong tailwind this year, refinance is facing the headwinds of rising rates. Real estate agents should enjoy another strong year but lenders will see a shrinking business continuing through 2022. Overall, the indicators are for a relatively smooth flight in the housing market currently constrained by limited inventory. As more people become either vaccinated or herd immune, expect listing inventory to grow as the year progresses. Sit back, relax and enjoy the flight.

Ted