Forecast Update: Home Sales, Residential Lending & Interest Rates by Fannie Mae & the MBA -- July 2021

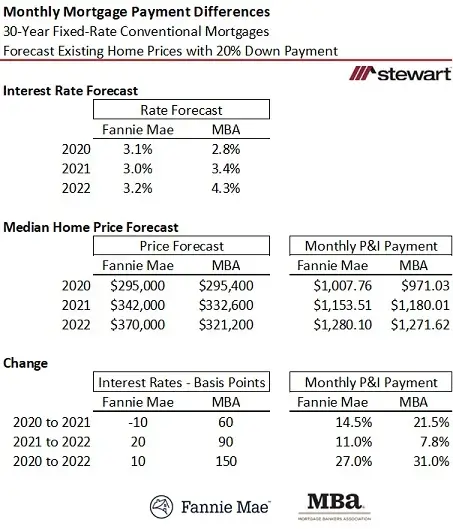

Axioms are truths. If there is ever one complete truth it is that not everyone sees the future equally, nor do they consistently perceive the present. Proof in the statement takes only a glance at the latest forecast for residential interest rates from Fannie Mae and the MBA (F&M). As shown in the table, not only do the two industry experts differ on where 30-year, fixed-rate residential mortgage rates were in 2020, they are at odds for 2021 and 2022. While Fannie Mae expects rates to drop 0.1 percent in 2021 and rise just 0.2 percent in 2022 to 3.2 percent, the MBA calls for rates to rachet-up 60 basis points this year and another 90 basis points (0.9 percent) in 2022 to 4.3 percent.

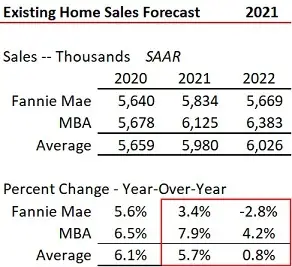

While F&M both expect existing home sales to increase in 2021 vs the prior year, Fannie Mae’s forecast gain (3.4 percent) is less than one-half that of the MBA’s (+7.9 percent). The divergence is greater in 2022 with the MBA prognosticating a 4.2 percent gain in existing home sales versus Fannie Mae’s almost 3 percent drop (-2.8 percent).

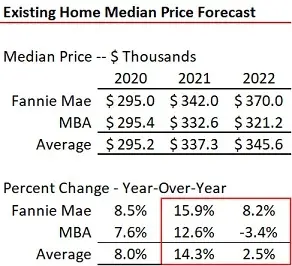

The different outlook continues across median homes prices, with Fannie at a 25.4 percent increase from 2020 to 2022 and the MBA at just 8.7 percent. Logically this makes sense based on Fannie Mae’s expectation of essentially flat interest rates in the timeframe and the MBA seeing a 150 basis point jump. Higher rates would dampen home price gains.

Affordability accordingly suffers on both the F&M forecasts, with the table showing respective implied monthly principal and interest payments based on respective median home prices and interest rates assuming a constant 20 percent down payment. Monthly P&I payments are forecast to increase by 27.0 percent and 31.0 percent from 2020 to 2022 by Fannie Mae and the MBA, respectively.

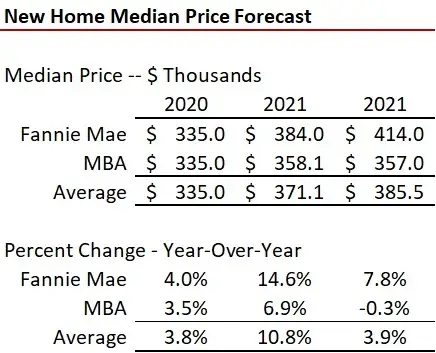

The next two tables show expectations for new home sales and median prices. While new home sales are significant, they are dwarfed by the 8.9 existing home sales on average for each new property closing since 2002. Builders continue to fight the headwinds of lot shortages, massive materials and appliance cost increases and limited availability, and a dearth of skilled construction workers.

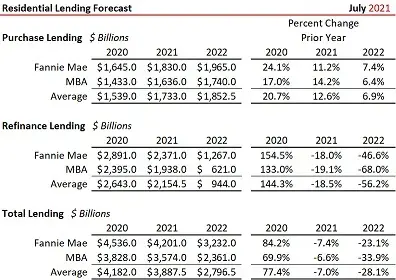

The last series of tables focus on residential lending – both purchase and refinance transactions. Purchase lending is anticipated to rise 12.6 percent in 2021 and another 6.9 percent in 2022 – averaged between F&M. Refinance, however, is anticipated from drop by 18.0 to 19.1 percent in 2021 and then plunge by 46.6 to 68.0 percent in 2022. Total lending volume (purchase + refi) is estimated to shrink by 7.0 percent in 2021 and another 28.1 percent in 2022 -- averaged across F&M. That is a projected 33.1 percent plunge from 2020 to 2022.

Restated again from last month’s summary:

“As shown, even the experts differ on where housing markets are heading, but agree on a declining refinance lending segment this year and next.. Following interest rates is the key to where the housing and lending markets are heading.”

Ditto. If realized, the lending and real estate transaction-based services will see a material shrinking pie regarding total revenues this year and next.