Commercial Real Estate Cycles for Q2 2021 -- Dr Glenn Mueller's Must-Read Quarterly Report

As the pandemic progresses through its lifecycle, the demand for commercial real estate continues to evolve with some property types and markets struggling and others booming. Detailed market-specific insight is critical to ascertain where individual real estate markets are currently at and where they are heading.

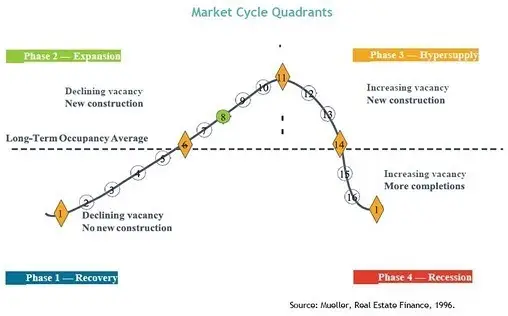

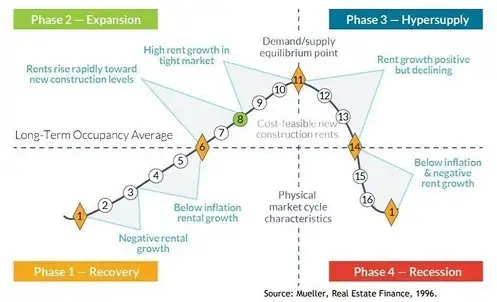

Dr Glenn Mueller’s quarterly Commercial Real Estate Cycles report gives just that perspective on what is going on in commercial real estate across the country with specifics for 54 metros for apartments, industrial, office and retail properties. Dr. Mueller defines four distinct phases in the commercial real estate cycle providing decision points for investment and exit strategies. Long-term occupancy average is the key determinant of rental growth rates and ultimately property values. Ideally, Phase 2 - Expansion is the ideal quadrant for real estate investor performance as shown in the following two graphs and discussion.

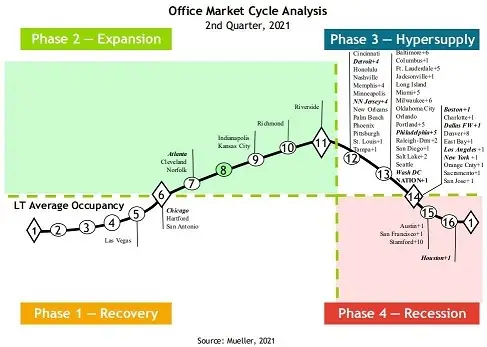

Across the cycle, Dr. Mueller describes rental behavior within each of the phases, using Market Levels ranging from 1 to 16. Equilibrium occurs at Market Level 11 in which demand growth equals supply growth – _literally the sweet spot_. The equilibrium Market Level 11 is also the peak occupancy level.

Phase 1 - Recovery Declining Vacancy, No New Construction

1-3 Negative Rental Growth

4-6 Below Inflation Rental Growth

Phase 2 - Expansion Declining Vacancy, New Construction

6-8 Rents Rise Rapidly Toward New Construction Levels

8-11 High Rent Growth in Tight Market

Phase 3 - Hypersupply Increasing Vacancy, New Construction

11-14 Rent Growth Positive But Declining

Phase 4 - Recession Increasing Vacancy, More Completions

14-16, then back to 1 Below Inflation, Negative Rent Growth

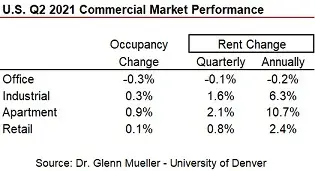

Rents and occupancy changes for Q2 2021 are detailed for the U.S. in aggregate in the following table. Office was the only one of four property types showing an annual and quarterly decline in rents. Big winners were apartments and industrial properties.

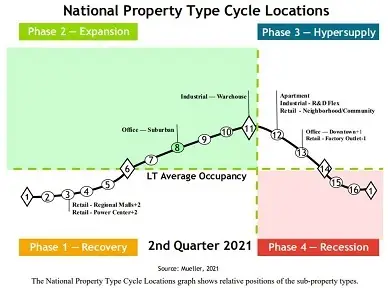

Dr. Mueller’s Q2 2021 report shows the current cycle stage from a national perspective across property types. Only Industrial Warehouses are at Equilibrium Market Level 11-- which makes sense given the massive surge of e-commerce sales at the onset of the pandemic and continuing growth. Suburban Offices are also in the desired Phase 2 - Expansion at Market Level 8.

Apartments, Industrial (Research & Development and Flex Space), Downtown Offices and Retail (Neighborhood/Community), with growing ecommerce, ongoing new deliveries, and a pipeline of construction, are in Phase 3 - Hypersupply with rents still increasing but at a declining rate. Retail Power Centers and Regional Malls moved from Phase 4 – Recession in Q1 2021 to Phase 1 – Recovery where there is no construction and rents decline. Retail Factory Outlet improved from Phase 4 – Recession in Q1 2021 to Phase 3 – HyperSupply in Q2 2021.

Office is shown in the next table for 54 individual Metros across the country. [Download the report for all other property types.] Almost 3/4ths of the Metros in Mueller’s study (72.2 percent) were in Phase 3 – Hypersupply as of Q2 2021. Just 7.0 percent of the office markets were in Phase 2 – Expansion, the desired quadrant for rising rents. As described in Mueller’s full report, the number following the Metro shows how many Market Levels that specific metro changed from the prior quarter. Denver, for example, moved from Market Level 6 in Q1 2021 to Market Level 14 as of Q2 2021 – i.e . +8. Markets that are shown in _bold italic_ font (11 of the 54 office markets) make up 50 percent of the total space monitored by Mueller’s report.

Mueller’s quarterly report is based on almost 300 individual econometric models. Unfortunately data for hotels are no longer available.

Pay attention to each of the property types in the report focusing on cities that have excess supply, and also those with supply trailing demand.

To download current and historical quarterly reports click