Housing Market & Residential Lending Forecast September 2021

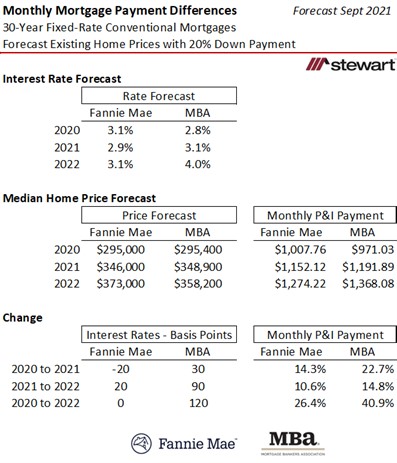

The summary of the latest monthly forecasts of residential housing markets and lending from Fannie Mae and the MBA are summarized. Interest rates are an integral component of housing sales and residential lending and have remained below 2.9 percent (conventional, fixed-rate 30-year mortgages) since early July according to Freddie Mac. The latest interest rate forecasts are shown in the first table. While Fannie Mae remained unchanged in their outlook from August, the MBA lowered their 2021 number from 3.3 percent to 3.1 percent and reduced 2022 from 4.2 to 4.0 percent.

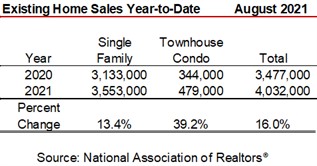

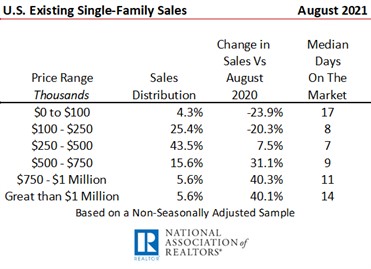

Existing Home Sales

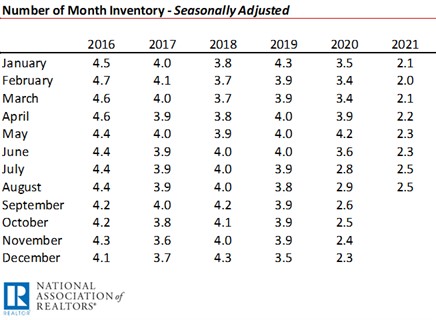

Existing home sales forecasts on a seasonally adjusted annualized rate (SAAR) and median price expectations are shown in the next two tables. While Fannie Mae and the MBA each see sales rising in 2021, the MBA expectation calls for 3.2 percent more existing home sales in 2021 than Fannie Mae and 14.4 percent in 2022. When compared to their respective forecasts for 2021, Fannie Mae sees existing home sales shrinking 3.6 percent in 2022 while the MBA sees a 6.8 percent gain. The big change in home price expectations from the prior month was from the MBA – raising the 2022 median from $327,800 to $358,200. Still, Fannie Mae’s estimated 2022 price gain of 7.8 percent is nearly triple the MBA’s 2.7 percent.

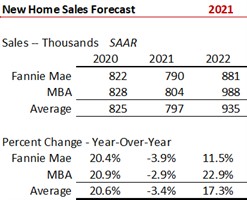

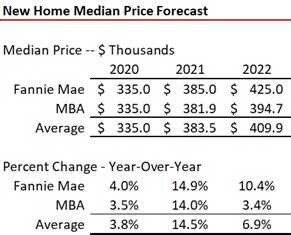

New Home Sales and Median Prices

The MBA continues to be more optimistic regarding new home sales with an expectation of 988,000 in 2022 (down from 1 million in the prior month’s forecast) versus Fannie Mae’s 881,000. Builder headwinds of skilled-labor shortages, lack of materials availability, rising input costs and minimal lot supply remain in place hindering growth in new construction.

The MBA also raised their 2022 forecast for new home prices going from a median $360,900 (using their August expectation) for 2022 to $394,700 (based on the September model). They still trail Fannie Mae’s estimated $425,000 new median home price prognosis for 2022, however.

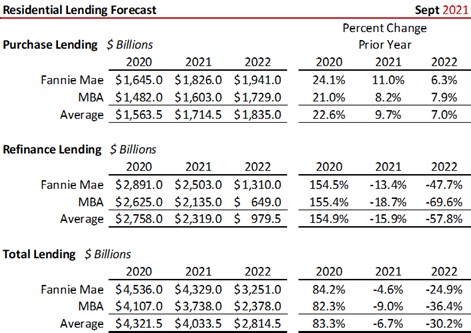

Residential Lending

Lending forecasts are detailed for both purchase and refinance transactions. The story is the massive 48 percent to 70 percent plunge in refinance volumes in 2022, respectively from Fannie Mae and the MBA. Purchase lending is expected to rise 9.7 percent (average) in 2021 and 7.0 percent in 2022.

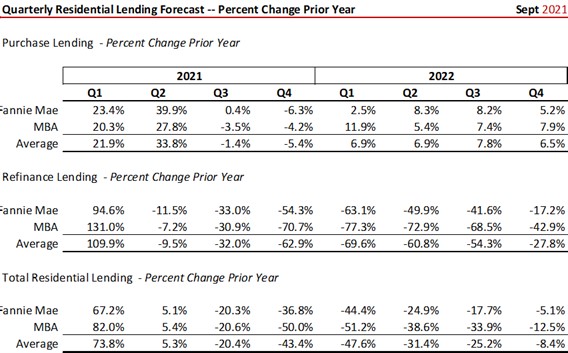

The next table shows the expected percentage change in lending volumes year-over-year on a quarterly basis. Total lending (purchase plus refinance) starts to precipitously decline in Q4 2021 (down 43.4 percent) and down almost one-half (47.6 percent) in Q1 2022 on a year-over-year basis. All of the decline is driven by quickly retracting refinance lending.

The next table shows the expected percentage change in lending volumes year-over-year on a quarterly basis. Total lending (purchase plus refinance) starts to precipitously decline in Q4 2021 (down 43.4 percent) and down almost one-half (47.6 percent) in Q1 2022 on a year-over-year basis. All of the decline is driven by quickly retracting refinance lending.

The last table combines the median price and interest rate forecasts and shows the respective principal and interest payment (P&I) assuming 20 percent down. The estimates call for P&I monthly payment to increase 26.4 percent (Fannie Mae) and 40.9 percent (MBA) from 2020 to 2022, dramatically impacting affordability.

To view and download these forecasts, click the following links:

- https://www.fanniemae.com/research-and-insights/forecast/forecast-monthly-archive

- https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary/mortgage-finance-forecast-archives

Restated for the fourth month in a row:

“As shown, even the experts differ on where housing markets are heading, but agree on a declining refinance lending segment this year and next. Following interest rates is the key to where the housing and lending markets are heading.”

When it comes to interest rates -- the key to the housing market -- things change. When rates rise all bets are off as not only will refi lending volumes plunge, but also home sales and home price gains. For now however, it continues remain a great market.

This massive head-on collision on affordability (with projected P&I payments increasing from 26.4 percent to 40.9 percent from 2020 to 2022) is my greatest long-term concern for the economy. In 2019 (latest data available) hoseowner’s primary dwelling equity made up 26 percent of all U.S. household net worth according to the Survey of Consumer Finances conducted by the Federal Reserve. If housing is removed from the investment equation due to affordability, then those households will not participate in what historically has been one of the largest stores of wealth for middle-class America.

Ted