Commercial Real Estate Cycles Across the U.S. & 55 Metros, 5 Property Types - Q3 2022 Dr Glenn Mueller

While inflation and the ongoing recovery from the pandemic spurred demand for certain types of commercial real in the first half of 2022, the expectation by many for a recession in 2023 saw sales and the demand for commercial real estate shrink in Q3 2022 across all property types. Detailed market-specific insight is critical to ascertain where individual real estate markets are currently at and where they are heading.

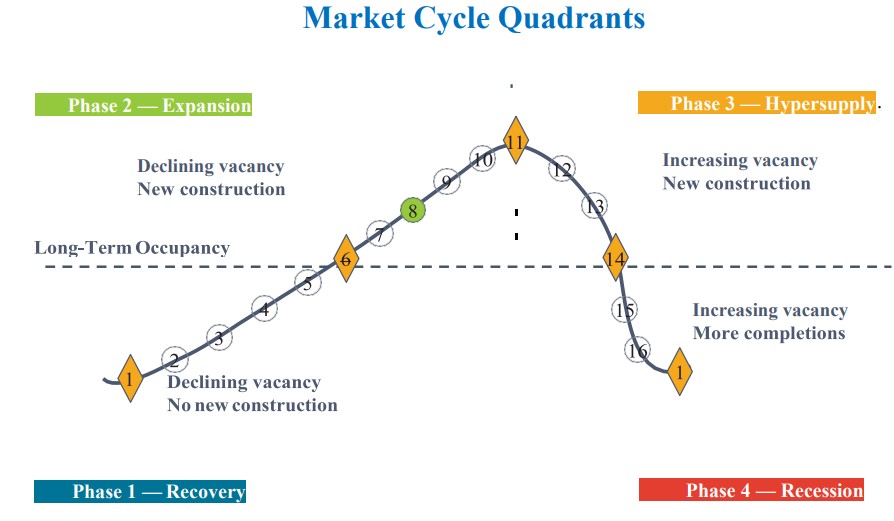

Dr Glenn Mueller’s quarterly Commercial Real Estate Cycles report gives just that perspective on what is going on in commercial real estate across the country with specifics for 55 metros for Apartments, Industrial, Office, Retail and Hotel properties. Dr. Mueller defines four distinct phases in the commercial real estate cycle providing decision points for investment and exit strategies. Long-term occupancy average is the key determinant of rental growth rates and ultimately property values. Ideally, Phase 2 - Expansion is the ideal quadrant for real estate investor performance as shown in the following two graphs and discussion. All graphs in this summary are taken directly from Dr Mueller’s Q3 2022 report.

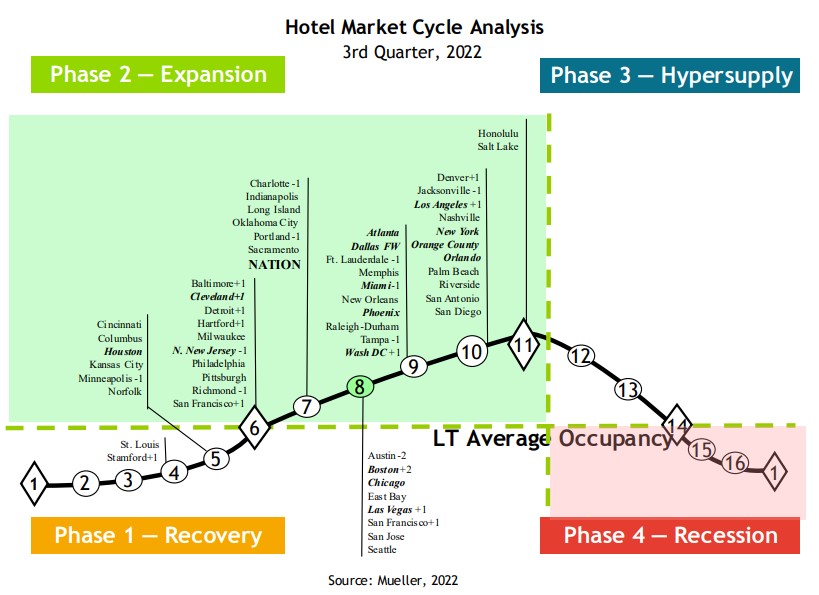

Across the cycle, Dr. Mueller describes rental behavior within each of the phases, using Market Levels ranging from 1 to 16. Equilibrium occurs at Market Level 11 in which demand growth equals supply growth – literally the sweet spot. The equilibrium Market Level 11 is also the peak occupancy level.

Phase 1 - Recovery Declining Vacancy, No New Construction

1-3 Negative Rental Growth

4-6 Below Inflation Rental Growth

Phase 2 - Expansion Declining Vacancy, New Construction

6-8 Rents Rise Rapidly Toward New Construction Levels

8-11 High Rent Growth in Tight Market

Phase 3 - Hypersupply Increasing Vacancy, New Construction

11-14 Rent Growth Positive But Declining

Phase 4 - Recession Increasing Vacancy, More Completions

14-16, then back to 1 Below Inflation, Negative Rent Growth

Rent growth across the cycle is characterized as follows:

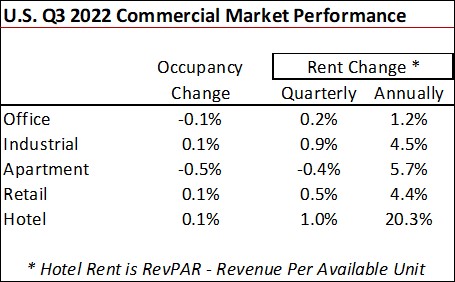

Rents and occupancy changes for Q3 2022, as reported by Mueller, are detailed for the U.S. in aggregate in the following table. Essentially only apartments saw a change in occupancy in Q3 2022, down 0.5 percent. The apartment segment was also the only property type to see a decline in quarterly rents, but just a minimal 0.4 percent. All property types posted annual rent increases, but hotels up 20.3 percent topped the list. Recall, however, the massive fall in in hotels at the onset of the pandemic.

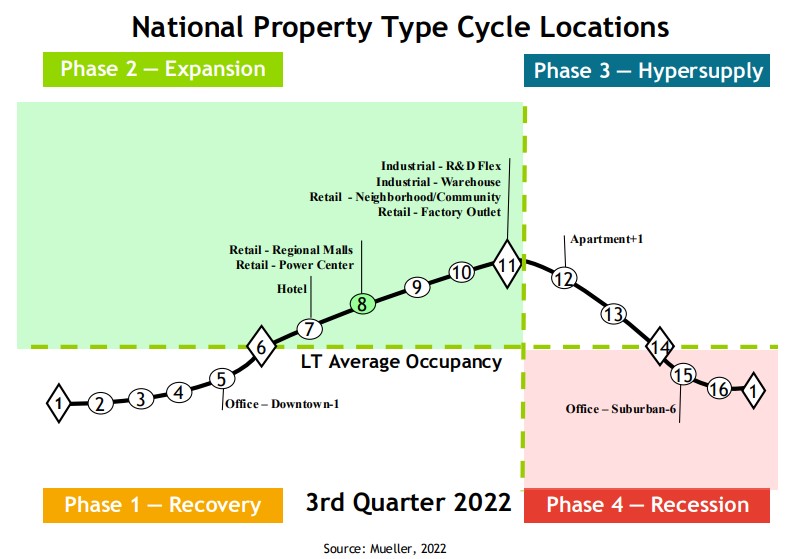

Dr. Mueller’s Q3 2022 report shows the current cycle stage from a national perspective across property types. Industrial (R&D Flex & Industrial), Retail (Neighborhood/Community, Factory Outlet, Regional Malls & Power Centers) and Hotel property types were in Phase 2 – Expansion in Q3 for the U.S. Property types at the peak performance Market Level 11 included: Industrial R&D – Flex, Industrial – Warehouse, Retail – Neighborhood/Community (think grocery stores), and Retail – Factory Outlet. Offices – Downtown were relegated to Phase 1 – Recovery. Apartments were in Phase – 3 Hypersupply and Office Suburban was classified in Phase 4 – Recession.

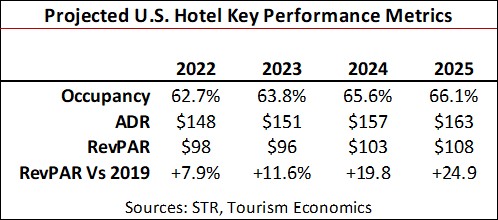

The same is not true when it comes to individual markets across the country. The summary for Hotel properties is shown in the next table for 55 individual Metros across the country. [Download the report for all other property types – link is below.] The Hotel market crashed and burned (economically so-to-speak) at the start of the pandemic. Today, however, growing travel is driving vast gains in occupancy rates, Average Daily Rates (ADR) and Revenue Per Available Room (RevPAR). STR and Tourism Economics just updated their forecast for 2023 through 2025 showing RevPAR expectations to be greater than 2019, the year prior to the pandemic.

Forty seven of the metros were in Phase 2 – Expansion, but just two, Honolulu and Salt Lake City were at the Equilibrium Market Level 11. None of the Metros in Mueller’s Q3 2022 study were in Phase 3 – Hypersupply or in Phase 4 - Recession. The 11 markets that are shown in _bold italic_ font make up 50 percent of the total space monitored by Mueller’s report. The numbers with + or – following the metro name show the change of that metro’s Market Level from the prior quarter.

Mueller’s quarterly report for the 55 covered metros and the U.S. is based on almost 300 individual econometric models.

Pay attention to each of the property types in the report focusing on cities that have excess supply, and also those with supply trailing demand.

To download current and historical quarterly reports click daniels.du.edu/burns-school and scroll down to the REAL ESTATE MARKET CYCLE REPORT section on the Website.

For the Q3 2022 report click Microsoft Word - Cycle Monitor 22Q3.docx (du.edu)

To learn more about Dr Glenn Mueller click daniels.du.edu/directory/glenn-mueller

For commercial real estate practitioners, Dr Mueller’s is essential reading quarterly. Again, thanks to Glenn for exceptional cutting-edge commercial research.