Existing Home Sales Continue to Shrink in March 2022 While Prices Hit a New Record High

Existing Home Sales March 2022 – National Association of Realtors® (NAR)

Box Score

As of March 2022

Seasonally Adjusted Annualized Sales Numbers (SAAR)

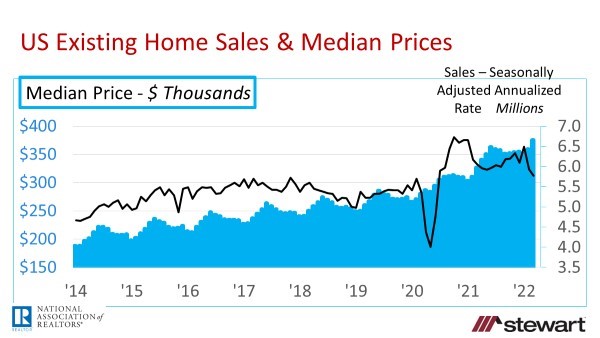

5.77 million SAAR as of March 2022

down 2.7 percent sequentially from February 2022 which tallied 5.93 million

down 4.5% percent year-over-year from 6.04 million in March 2021

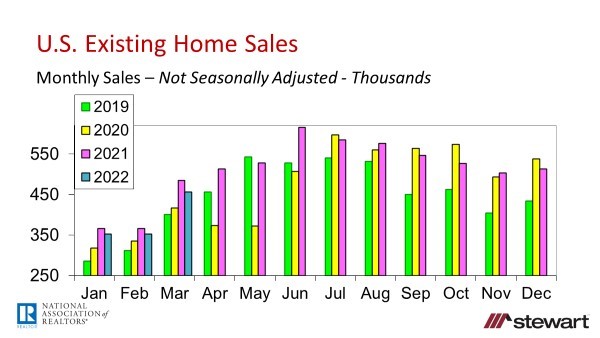

Monthly Sales _– raw data not seasonally adjusted_

456,000 for the month of March 2022

up 29.5 percent sequentially versus the 352,000 sales in February 2022

down 5.8 percent versus the 484,000 sales in March 2021

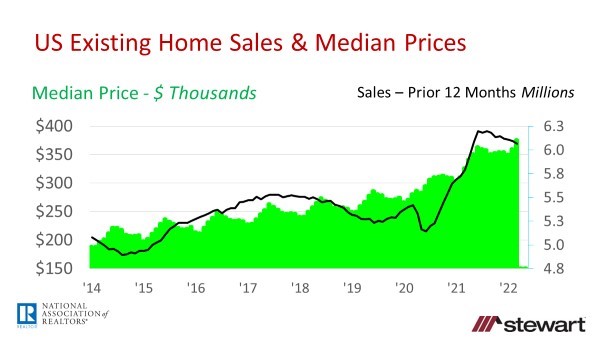

Sales Trailing 12-Months _– raw data not seasonally adjusted_

6.064 million for the 12-months ending March 2022 _– raw data not seasonally adjusted_ down 0.5 percent vs 12-months ending February 2022 of 6.092 million

up 4.7 percent vs 12-months ending March 2021 of 5.792 million

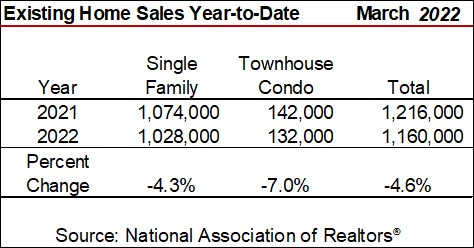

Sales Year-to-Date _– raw data not seasonally adjusted_

Median Price – March 2022 _due to historic monthly seasonality of existing home prices, only a year-over-year comparison is made_

_$375,300 – not seasonally adjusted_ up 15.0 percent vs $326,300 March 2021

Average Price – March 2022 _due to historic monthly seasonality of existing home prices, only a year-over-year comparison is made_

$387,100 – _not seasonally adjusted_ up 9.6 percent vs $353,100 recorded in March 2021

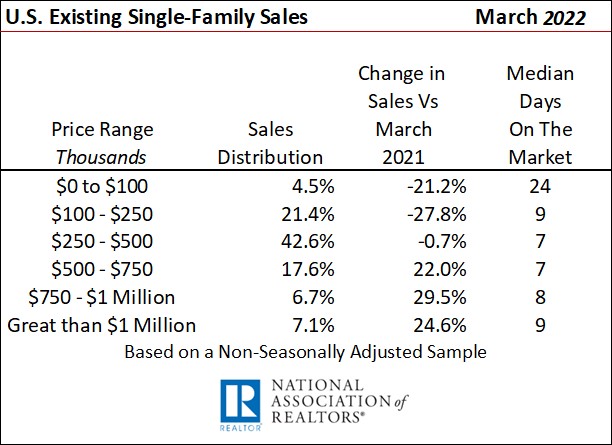

Single-Family Sales by Price and Median Days on the Market Prior to an Accepted Purchase Contract _– sample data not seasonally adjusted_

Primary reason sales priced $250,000 and less are down is minimal inventory

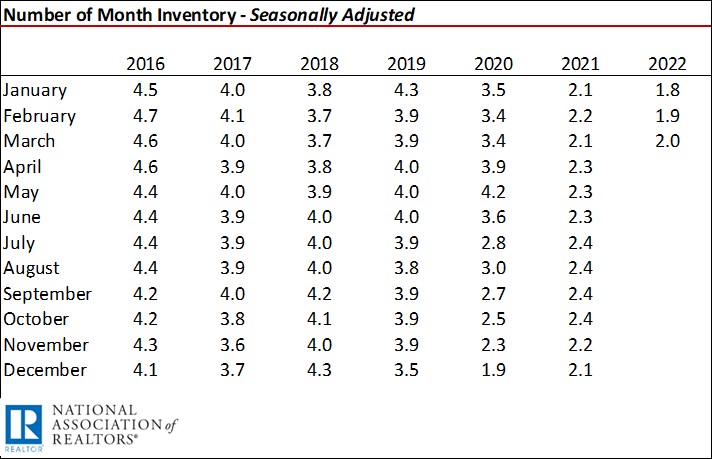

Months Inventory – with 6.0 months inventory considered normal from a historical perspective – _Seasonally Adjusted_

Graphs

Other Details Included in the NAR March 2022 Release

- Median price has risen 121 consecutive months on a year-over-year basis

- Inventory rose 11.8 percent from February 2022 to March 2022 to 950,000 active listings and was down 9.5 percent compared to March 2021

- Months Inventory at the end of March 2022 was 2.0 months (not seasonally adjusted), up slightly from the 1.9 months measured in the prior month

- Typical property was on the market 17 days prior to an accepted purchase contract versus 18 days each in February 2022 and one-year ago

- 87 percent of homes closed in March 2022 were on the market less than one month before going under contract

- 1 st time homebuyers accounted for 30 percent of March closings, down from 32 percent one-year ago. Continuing erosion of affordability will no doubt negatively impact 1 st -time homebuyers ability to access the great American dream given rising prices and rising interest rates

- Investors purchased one-in-five homes (19 percent) sold in March 2022, unchanged from 19 percent in the prior month but up from 15 percent 1-year ago

- Buyers paid all-cash 28 percent of the time, up from 23 percent one-year ago

- Distressed sales – foreclosures and short sales – are still not an issue making up less than 1 percent of March 2022 transactions - unchanged from the prior month & year-over-year. Most homeowners unable to make their mortgage payments today merely need to list the property with a real estate agent and prepare to walk with equity from a closing sometime in the next 30 to 60 days in this tight housing market.

Read the full press release from NAR here.

Headwinds in 2022 include quickly rising interest rates, affordability issues and uncertainty of the economy given the ever-evolving pandemic and now global conflicts. A major anticipated change is cooling of the rocketing trajectory of median prices (up 15.0 percent in the 12-months ending March 2022).

Housing sales are shrinking due escalating interest rates and a waning impact from COVID 19.

In the early 2000s I concluded that the start of a weakening housing market featured both a reduction in total home sales in the prior 12-months but with significant increases in median price. That perfectly describes the situation today. I believe at year-end we look back to 2021 as the peak of the U.S. housing market in this economic cycle.

Follow me on Twitter at twitter.com/DrTCJ

Given the changes in how buyers search for homes and the technology utilized, it is time to revisit what defines normal inventory. With the typical home receiving an accepted offer in 17 days in March 2022, the time from listing-to-contract continues to compress.