Home Sales and Residential Lending Forecast by Fannie Mae and The MBA - June 2022

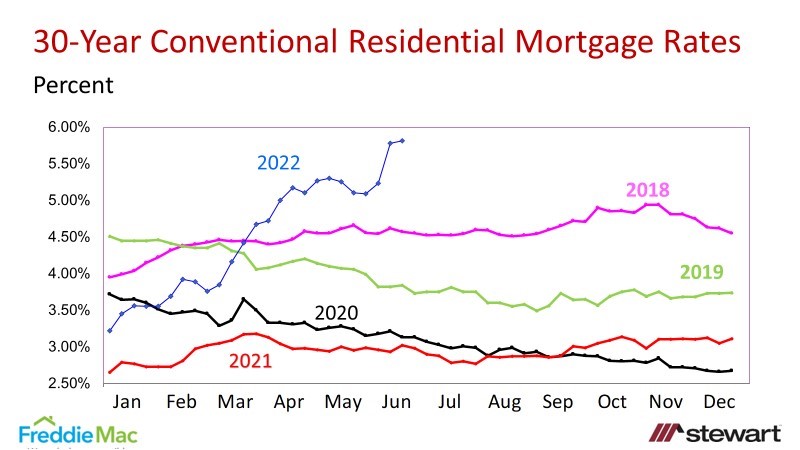

The summaries of the latest monthly forecasts as of June 2022 for U.S. residential housing markets and lending from Fannie Mae and the MBA are detailed below. The unanticipated jump in interest rates has seen a material swing in existing and new home sales and residential lending volumes for both purchase and refinance transactions. The latest conventional 30-year fixed-rate mortgage loan rates are shown in the first graph as tracked weekly by Freddie Mac’s Primary Mortgage Market Survey. As of this week, the 5.81 percent level is the highest seen in 14 years.

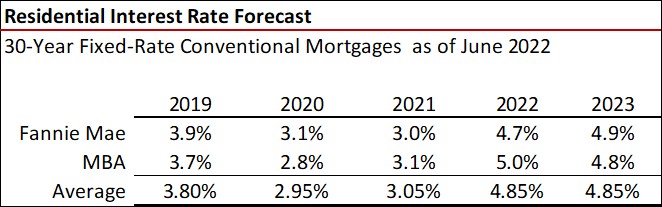

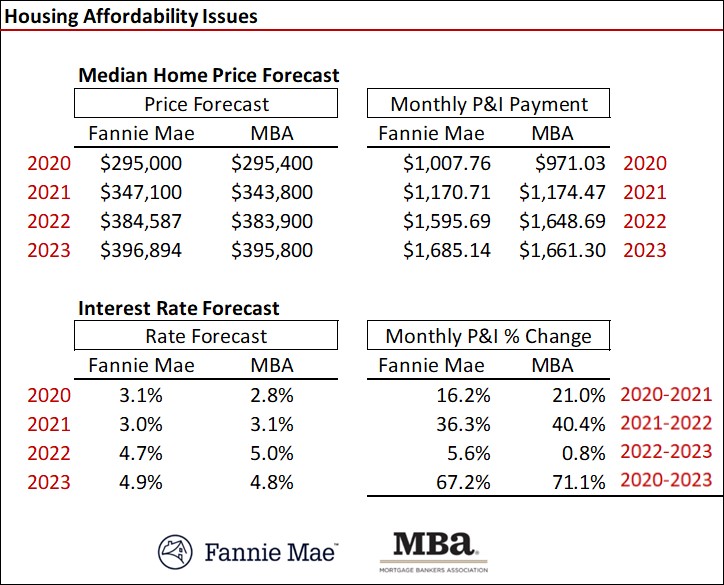

The latest interest rate forecasts from Fannie Mae and the MBA are shown in the first table with the expectation that rates in 2022 and 2023 will be up approximately 180 basis points compared to 2021. Note, however, that Fannie Mae’s 2022 forecast calls for an average 4.7 percent for the year while the MBA is at 5.0 percent, yet the latest weekly rate reported by Freddie Mac in 5.81 percent. This implies an expectation by both Fannie Mae and the MBA for declining rates as 2022 progresses.

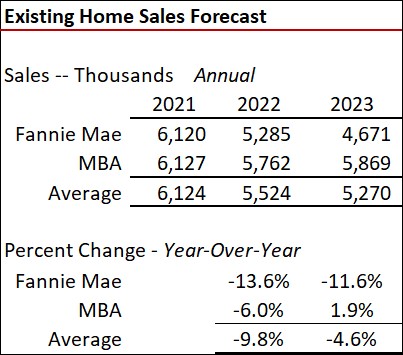

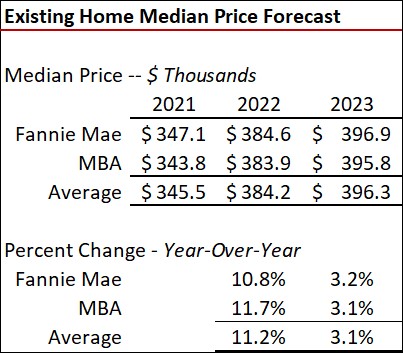

Existing Home Sales

Existing home sales forecasts on a seasonally adjusted annualized rate (SAAR) and median price expectations are shown in the next two tables. Both Fannie Mae and the MBA each see sales declining in 2022 but by differing levels. The MBA forecasts a 6.0 percent drop while Fannie Mae says it will be more than double that at 13.6 percent. Fannie Mae calls for added 11.6 percent decline in 2023 while the MBA expects sales to increase 1.9 percent. Both see strong home price gains in 2022 with Fannie Mae at +10.8 percent and the MBA at +11.7 percent. That growth is expected to shrink to the low 3 percent level in 2023.

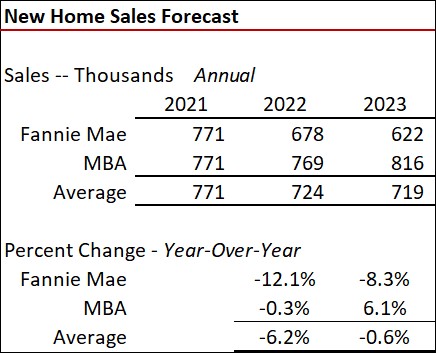

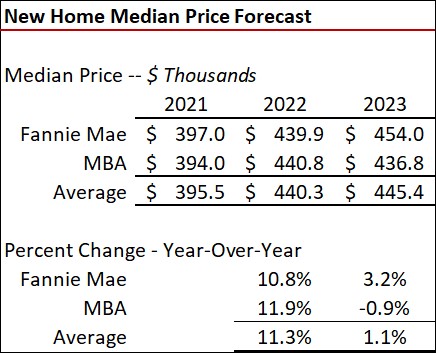

New Home Sales and Median Prices

The MBA continues to be more optimistic regarding the outlook for new home sales and sees them essentially flat (-0.3 percent) in 2022 versus a 12.1 percent drop by Fannie. The spread becomes even larger in 2023 as Fannie Mae calls for a 8.3 percent decline compared to the MBA’s 6.1 percent increase. New home prices are expected to go up approximately 11 percent in 2022 and then remain relatively unchanged in 2023.

The next table compares the principal and interest payments (P&I) for the median priced home (assuming 20 percent down) in 2020 versus 2023 using both Fannie Mae’s and the MBA’s current median price and interest rate forecasts. Fannie Mae sees the typical monthly P&I payment increase a staggering 67.2 percent from 2020 to 2023 while the MBA estimates rockets up 71.1 percent. This massive monthly price payment increase leads me to support the expectation of declining home sales for both new and existing home sales in 2022 and 2023 and likely pressure on home prices.

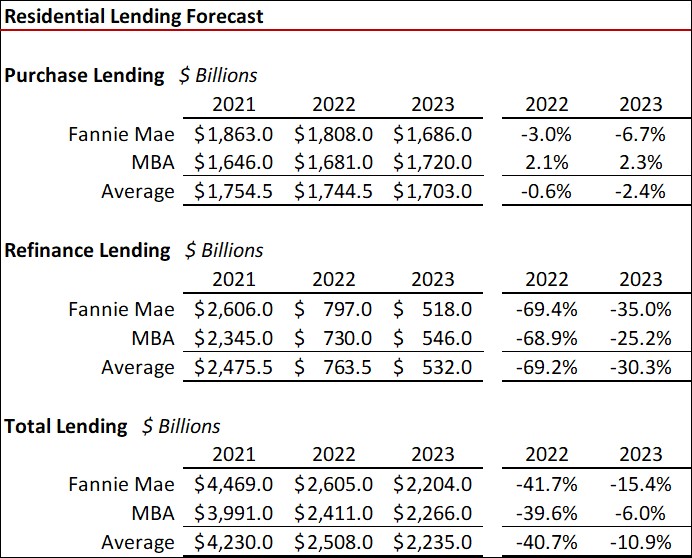

Residential Lending

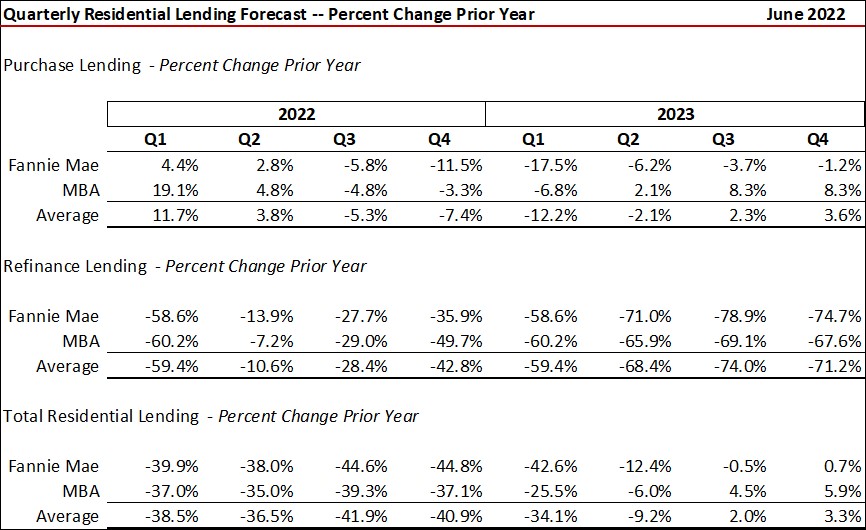

Lending forecasts are detailed for both purchase and refinance transactions in the next table. Focus is on the massive 69.2 percent (average) plunge in refinance lending volumes in 2022. Total lending (Purchase + Refinance) is expected to drop 40.7 percent (average) in 2022 and another 10.9 percent in 2023. That means that for every 10 residential loan officers in 2021 one-half will not be needed by the end of 2023. Mortgage lenders are already in major layoff moves.

The last table shows the expected percentage change in lending volumes year-over-year on a quarterly basis. This should surprise no one given the all-time record lending in 2021 being shaved by quickly escalating interest rates.

To view and download these forecasts, click the following links:

- Fannie Mae: Forecast - Monthly Archive

- Fannie Mae: Mortgage Finance Forecast Archives

The latest weekly interest rate data from Freddie Mac can be found at:

- Freddie Mac: Primary Mortgage Market Survey

Affordability continues to quickly evaporate due to the combination of rising home prices and interest rates and will negatively impact home sales. How much home sales will decline is now being further blurred given the potential recession and the Federal Reserve’s stance on trimming the highest inflation rate seen in 40 years.