Homes Sales and Residential Lending Forecast by Fannie Mae and The MBA - July 2022

“The life of an airplane pilot features hours of boredom sprinkled with a few seconds of sheer terror,” said Pappy Boyington, the highly decorated WWII Ace fighter pilot. While there is no comparison to what they do each day, airplane pilots and economists are somewhat similar. For economists, current trends are likely the best indicator of what happens next until an event comes along that changes those trends. It is a new – and often unpredictable – event that creates massive uncertainty and unknowns. While it is easy to forecast an ongoing trend, the difficulty is identifying the events that change trends. In recent decades major events included 911, the burst of the housing bubble and the COVID 19 driven pandemic. While some economists had foresight into those events, the majority did not. Today the event is rampant inflation that has yet to be fully understood and factored into the outlook for the economy and real estate.

Each month Fannie Mae and the Mortgage Bankers Association (MBA) issue forecasts for the economy and housing. To show how quickly expectations can change, comparisons are shown using their forecasts as of January and July 2022 – a change of just six months.

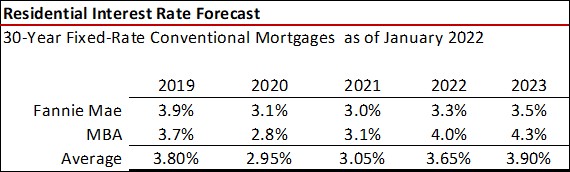

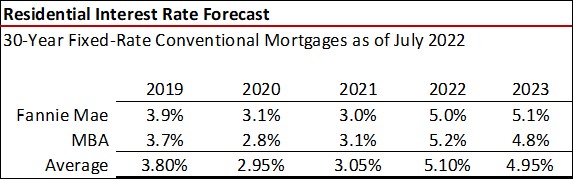

30-Year Fixed-Rate Conventional Mortgage Rates

The first contrast is the forecast for 30-year conventional mortgage loan interest rates. The unexpected inflation impact (at least from Fannie Mae) saw their forecast rocket up from a 3.3 percent average conventional mortgage rate for 2022 to 5.0 percent – a 170 basis point gain change in the six months from January to July of 2022. In the same period, the MBA’s forecast rose from 4.0 percent to 5.2 percent, up 120 basis points.

As of January 2022

As of July 2022

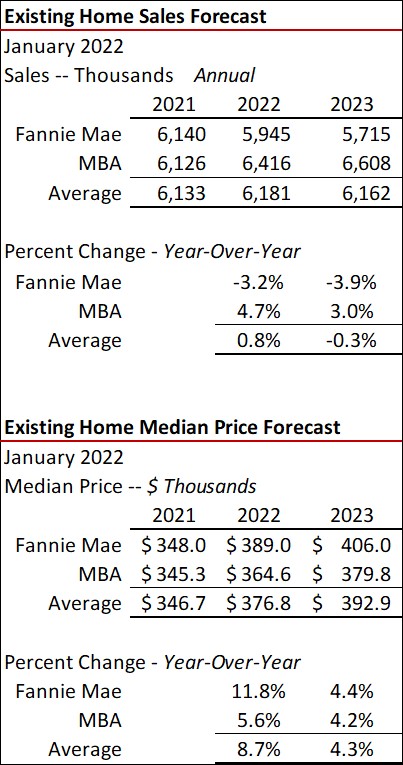

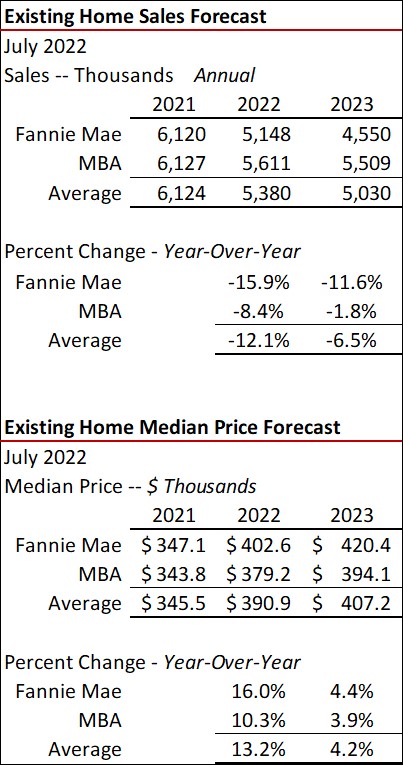

Existing Home Sales

Existing home sales are the core of residential real estate activity, with an average 7.8 existing home sales per new home sale average since 2002. The next table shows the forecasts for existing home sales and median prices by Fannie Mae and the MBA. At the beginning of 2022, the average forecast for existing home sales called for an essentially flat market – up 0.8 percent. As of July the forecast decayed to an average 12.1 percent cut in 2022 and another 6.5 percent decline in 2023. Both see rising median prices for 2022 and 2023, though Fannie Mae is more bullish. At the beginning of the year, Fannie Mae forecast included actual dollar median estimates for quarterly and annual numbers. Now they report a Fannie Mae Home Price Index (HPI) change comparing Q4 year-over-year. Thus the July 2022 median forecast prices from Fannie Mae are the prior year median indexed by the HPI.

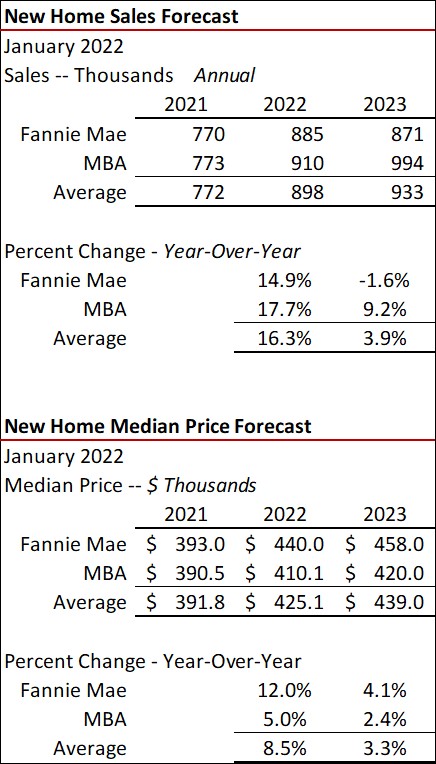

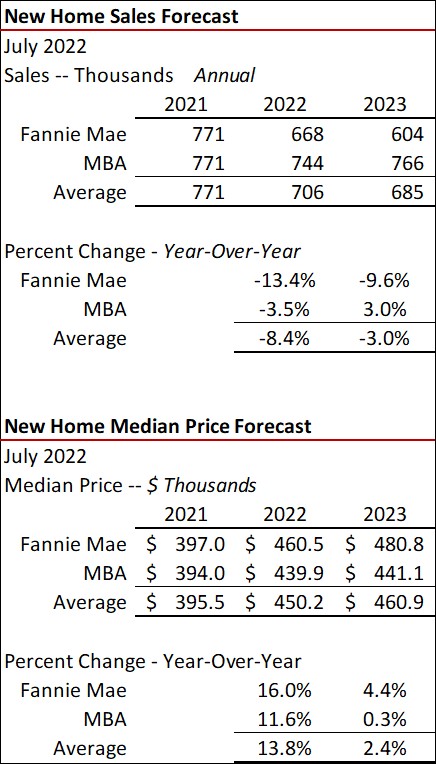

New Home Sales

The respective forecasts for new home sales and median prices are shown below. The MBA and Fannie Mae were optimistic about rising new home sales as of January, up an average 16.3 percent. As of July that gain is reversed to a decline in 2022 new home sales of 8.4 percent and another 3 percent dip in 2023.

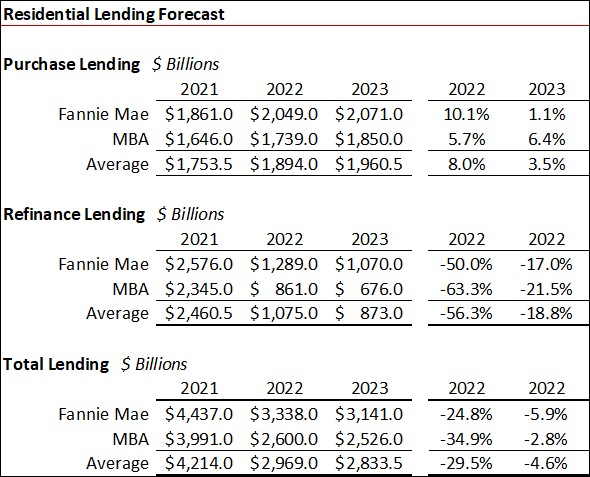

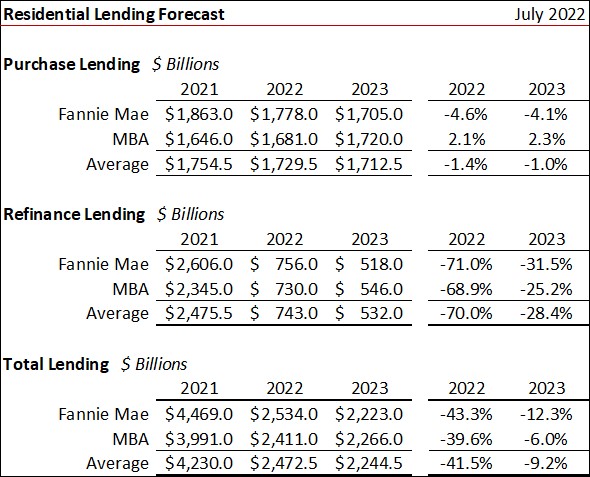

Purchase, Refinance and Total Residential Lending Forecasts

Inflation has impacted lending expectations for both purchase and refinance activities. At the beginning of the year purchase lending was expected to rise 8.0 this year and 3.5 percent more in 2023. Now, purchase lending is forecast to decline 1.4 percent in 2022 and another 1.0 percent in 2023. The largest change in expectations between the January and July forecasts was in refinance volume, originally expected to be down 29.5 percent in 2022 and another 4.6 percent in 2023. The latest prognostication calls for a 70.0 percent drop in 2022 and another 28.4 percent in 2023 – all driven by rising interest rates and a weakening economy.

As of January 2022

As of July 2022

Typical Monthly Principal and Interest Payments

Already known is the principal and interest (P&I) payment made by the buyer on a median-priced existing-home at the average annual rate in 2020, assuming 20 percent down. Since Fannie Mae and the MBA forecast median prices and interest rates, a comparison is made between the actual P&I in 2020 to their respective forecasts in 2023. As of January 2022, the average P&I payment was forecast to increase by 44.7 percent in 2023 Vs 2020 by Fannie Mae and 54.8 percent by the MBA. The July forecast now sees those P&I payments rocketing up 81.2 percent and 72.4 percent from 2020 to 2023 by Fannie Mae and the MBA, respectively.

Summary

Inflation and the resulting increase in interest rates are taking a toll on the U.S. housing sector, with significant declines in expected sales volumes, lending levels and muted home price gains. And that assumes no added events that could create even stronger headwinds. After years of watching trends just continue from 2010 through 2019, there was not much change for economists. Today economists wake up, strap in and tighten their seatbelts for a year-unknown ride in this changing economic landscape.