Housing and Residential Lending Outlook for 2022 and 2023 - Get Out the Smelling Salts

The latest residential lending and home sales forecasts from the MBA and Fannie are not a pretty picture. As my grand mother would say, “Get out the smelling salts so we can talk about this." Cutting to the bottom line, the results of September 2022 forecasts are summarized concisely below.

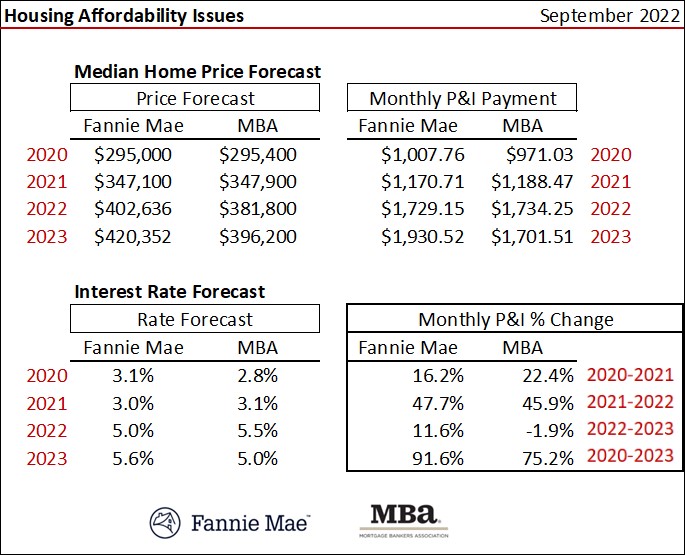

Monthly Principal & Interest Payments 2020 Vs 2023

Already known is the typical principal & interest payment (P&I) in 2020 for the median priced-home and the average annual interest rate. [Ironically, Fannie Mae and MBA differ on this slightly in 2020.] If the MBA is correct in their 2023 forecast, the typical P&I payment will be 75.2 percent greater Vs 2020. If Fannie Mae is on target, the monthly P&I payment in 2023 will be almost double the 2020 payment – up 91.6 percent. The gains are a function of both increased median price and interest rates. Though these are based on an average annual mortgage rate of 5.6 percent at most, Freddie Mac’s weekly _Primary Mortgage Market Survey_ last week found 30-year fixed-rate conventional mortgages were already 6.29 percent.

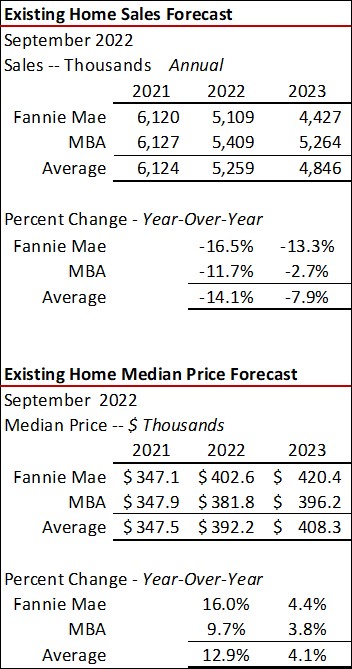

Existing Home Sales

The November 2021 forecast by Fannie Mae and the MBA saw 2022 and 2023 existing home sales essentially unchanged at 6.1 million dwellings. The latest 2023 forecast ranges from a high of 5.26 million (MBA) to a low of 4.43 million (Fannie Mae). Both forecasters see median prices up in 2023 Vs 2022. This is the reverse of the 10 to 15 percent decline from 2022 to 2023 forecast by Fitch Ratings.

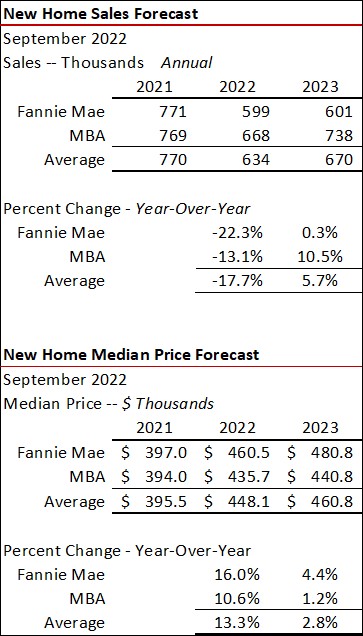

New Home Sales

Since 2002, there has been an average one new home sale for every nine existing home closings. Both forecasters see new home sales down in 2022 (an average 17.7 percent), but either flat or up 10.5 percent in 2023.

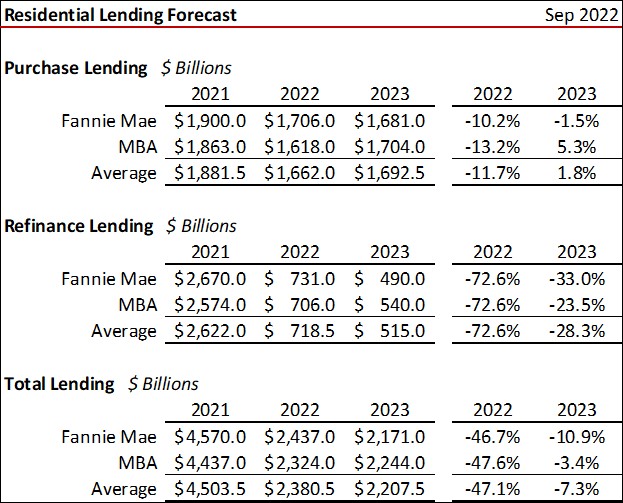

Residential Lending

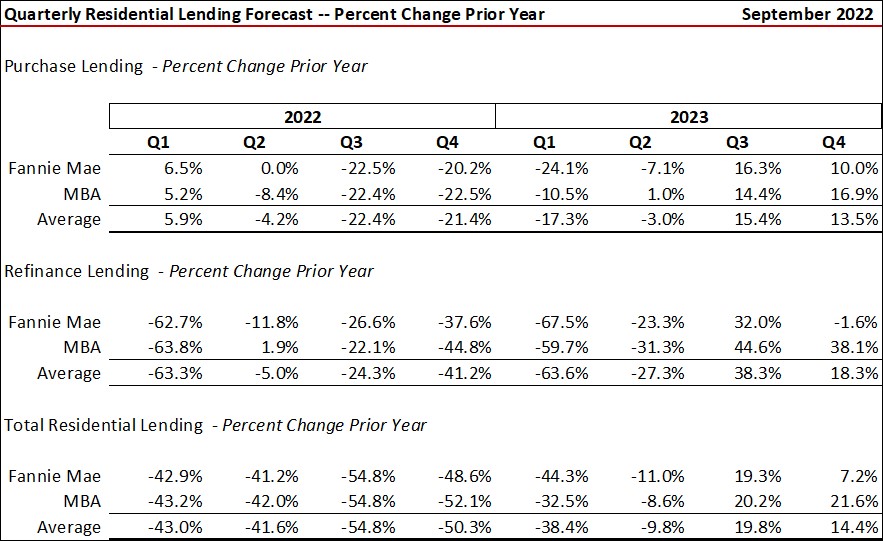

Rising interest rates have crushed refinance activity in 2022 compared to 2021 (down a projected 72.6 percent) and down another 23 percent to 33 percent in 2023. It is estimated that more than one-half of all residential mortgage lenders in business in 2021 are now out of a job in the mortgage industry.

The chart below shows quarterly year-over-year lending changes for purchase and refinance activity. If these forecasters are correct there is material pain still coming in the next nine months with respect to refinance lending volumes.

Can the outlook change? Yes, and it heavily depends on interest rates, whether a material recession takes place, consumer confidence and inflation. The U.S. Congress Joint Economic Committee estimates that inflation is costing the typical household in the country $715 more per month to maintain their lifestyle compared to one year ago. Assuming Freddie Mac’s 6.29 percent mortgage rate is reflective, the typical household lost a staggering $115,600 of loan capacity to buy a home assuming no change in income.

Pay attention to inflation and mortgage rates, and keep the smelling salts handy.