The Large Impact of a Small Number

Fannie Mae & MBA Housing Sales, Residential Lending & Mortgage Rate Forecasts December 2022

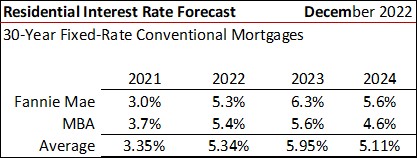

The residential mortgage interest rate roller coaster remains on track, but now with declining rates despite the Fed hikes of the target rates for Fed Funds. The Impact of a small number is revealed as expectations for interest rates decline from Fannie Mae. In Fannie Mae’s November 2022 forecast for 2023, fixed-rate conventional 30-year mortgage interest rates were projected to average 6.8 percent in 2023, up from 5.4 percent in 2022. Corresponding 2023 existing home sales were projected to drop a precipitous 22.5 percent from 2022 to 3.897 million homes, which would have been the fewest sales since 1995. The December 2022 revised annual average interest forecast for 2023 is now 6.3 percent, down 50 basis points from the prior month.

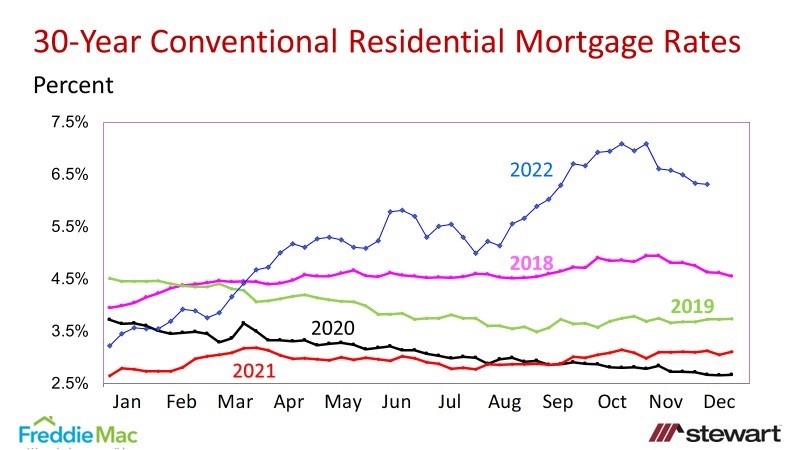

Conventional 30-year fixed-rate mortgage rates are shown in the following graph as reported by Freddie Mac in their weekly Primary Mortgage Market Survey (PMMS). The PMMS is now based on weekly loan applications from thousands of lenders across the country as of November 2022. Prior to this it was based on a weekly survey of lenders. The latest rate on December 15th was 6.31 percent – down from 7.08 percent the last week of October — the highest seen in 20 years.

Interest Rate Expectations

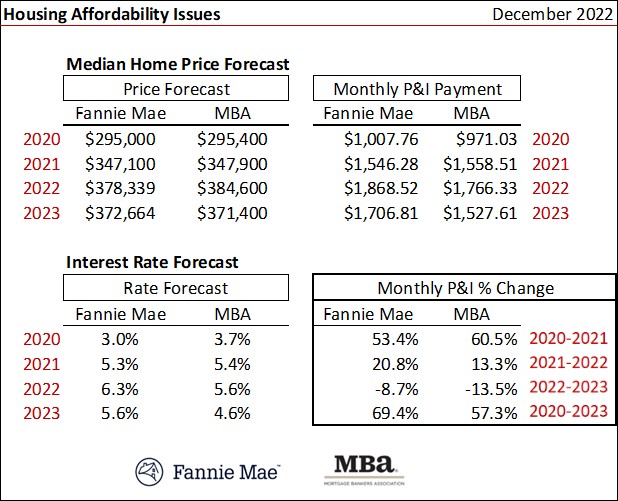

The latest mortgage rate averages are detailed in the table. The annual data for the MBA are restated (compared to previous blogs) to an average of the four quarters. The MBA reports annual rates as of the 4th quarter while Fannie Mae used a quarterly average. These two are now apples-to-apples. Both see rates rising in 2023 with Fannie Mae forecasting the largest gain.

Existing Home Sales & Median Prices

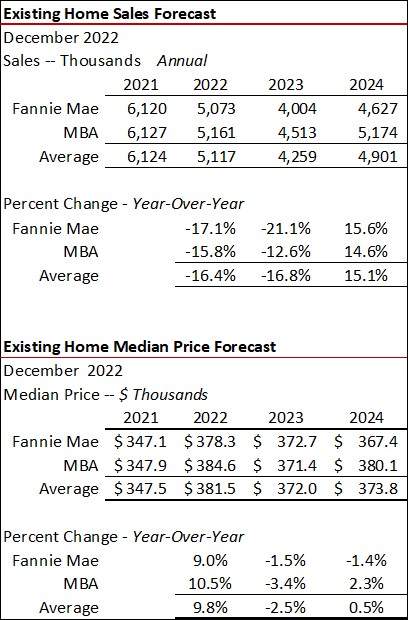

Fannie Mae and MBA forecast declining existing home sales in 2023. Fannie Mae, however, sees sales a 21.1 percent year-over-year drop to 4.0 million units. The MBA expects 4.5 million existing home sales which would be down 12.6 percent from 2022. My own forecast for the past six months has called for a 10 to 12 percent drop in 2023.

The two are similar in their forecasts of median prices, dipping from 1.5 percent to 3.4 in 2023. My personal forecast calls for median prices to dip from 10 percent to 14 percent in 2023 Vs 2022 due to an eroding economy, inflation, high rates and affordability issues.

New Home Sales

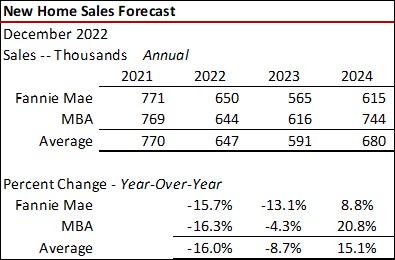

Since 2002, there has been an average one new home sale for every 8.9 existing home closings. Fannie Mae, given the expectation of much higher interest rates, forecasts new home sales dropping 13.1 percent in 2023 compared to MBA’s 4.3 percent dip. Both see a reasonable rebound in new home sales in 2024. Sales will likely decline even more than the two expect in 2023 based on the latest U.S. Census Bureau release this week of building permits for new privately-owned housing units, down 22.4 percent in November compared to a year ago and new construction starts down 16.4 percent.

Monthly Principal & Interest Payments 2020 Vs 2023

If the MBA is correct in their current 2023 forecast, the typical P&I payment will be 57.3 percent greater compared to 2020. If Fannie Mae is on target, the monthly P&I payment in 2023 will be up 69.4 percent Vs 2020. The increase in P&I is a function of changes in median price and interest rates and is a primary driver of declining home sales.

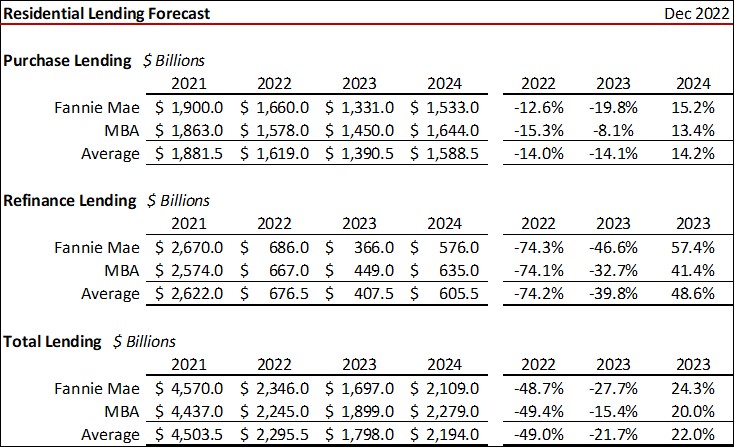

Residential Lending

Rising interest rates crushed refinance activity in 2022 compared to 2021 (down a projected 74.2 percent) with another 32.7 percent to 46.6 percent year-over-year drop in 2023. More than one-half of all residential mortgage lenders in business in 2021 are now out of a job in the mortgage industry with more cuts announced monthly. When all said and done in this interest cycle, for every 10 residential loan officers in 2021 there will be four or less by the end of 2023.

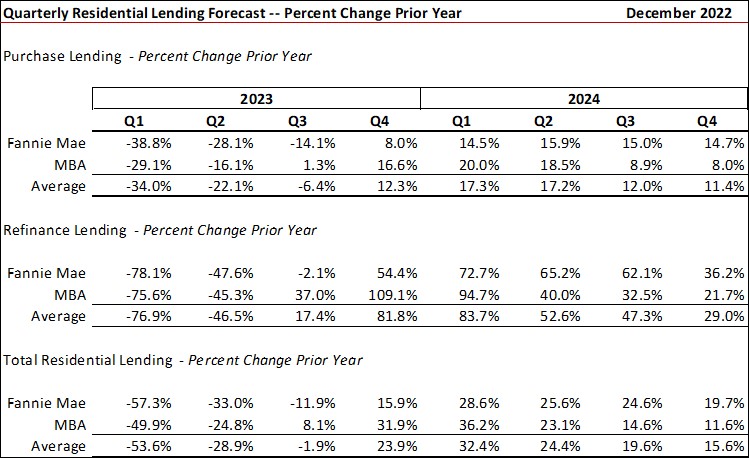

The chart below shows quarterly year-over-year lending changes for purchase and refinance activity. If correct, there is material pain still coming through the first two quarters of 2023 in the residential lending segment and residential brokerages.

The roller coaster ride continues fueled by Interest rates, jobs, consumer confidence and recession expectations. Stay focused on these metrics.