Q2 2023 Real Estate Cycles Across the U.S. & 54 Metros, 5 Property Types - Dr Glenn Mueller

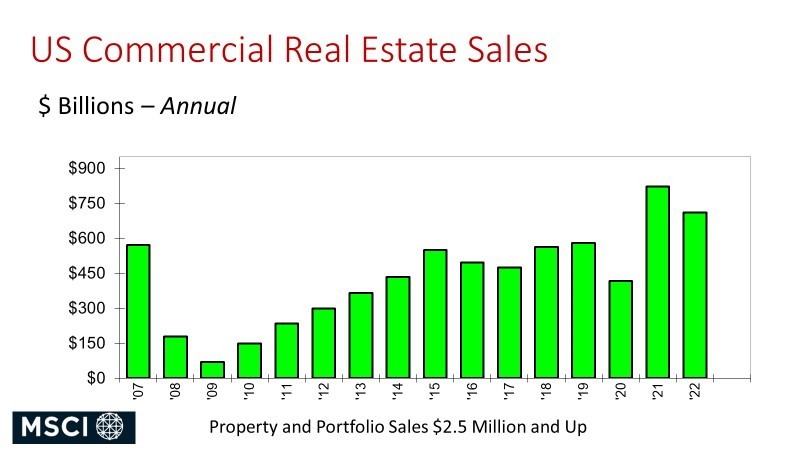

U.S. commercial real estate sales hit a record $912.5 billion in 2021 and then posted a second-best $730.7 billion in 2022 according to data from MSCI–Real Capital Analytics using individual and portfolio property sales of $2.5 million and greater across the U.S. The first graph shows the volatility of commercial sales annually since 2007, which prior to recent years had been the best on record.

Rising loan and cap rates commencing in Q4 2022 and continuing are eroding commercial real estate sales and values across the country. Total U.S. commercial real estate transaction volume year-to-date as of July 2023 was down a massive 59 percent with a staggering plunge of 74 percent for the month of July according to MSCI–Real Capital Analytics data. If the first two quarters of commercial real estate sales in the U.S. for 2023 follow the same seasonality of sales tallied from 2013 through 2019 (a period with minimal market shocks), sales are heading to $319.3 billion in 2023, down 56.3 percent from 2022 and the lowest seen since 2012.

The plunge in sales varies across property types and markets, however. One size does not fit all when talking about commercial real estate. One metro, for example, may have a tight office market while other cities are more than 30 percent vacant. And in those with 30 percent plus office vacancy, industrial space may be 3 percent or less empty. Key to optimizing returns is knowing where individual markets are heading across multiple property types.

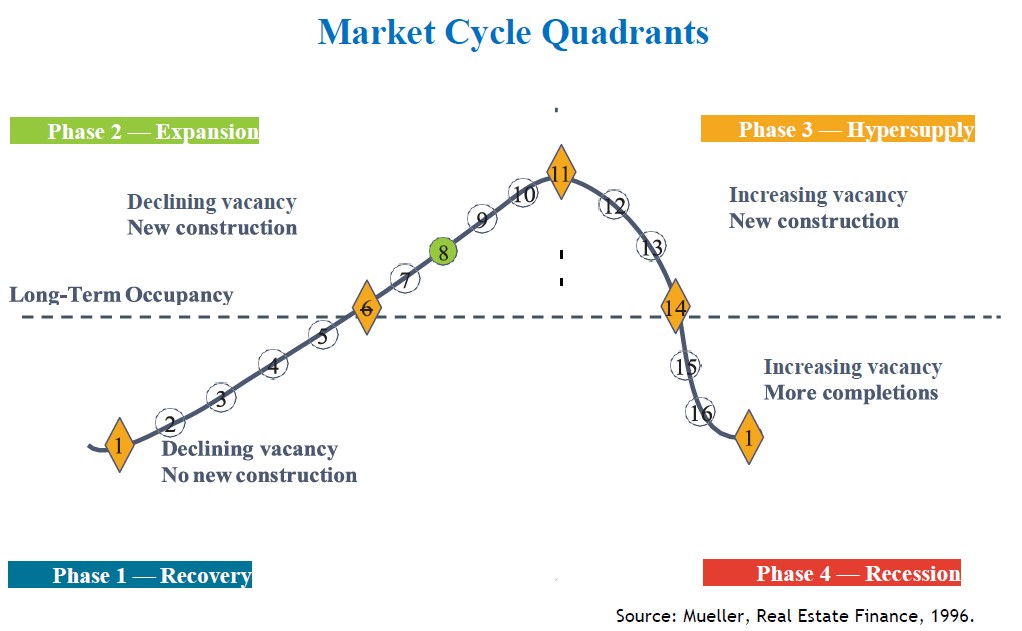

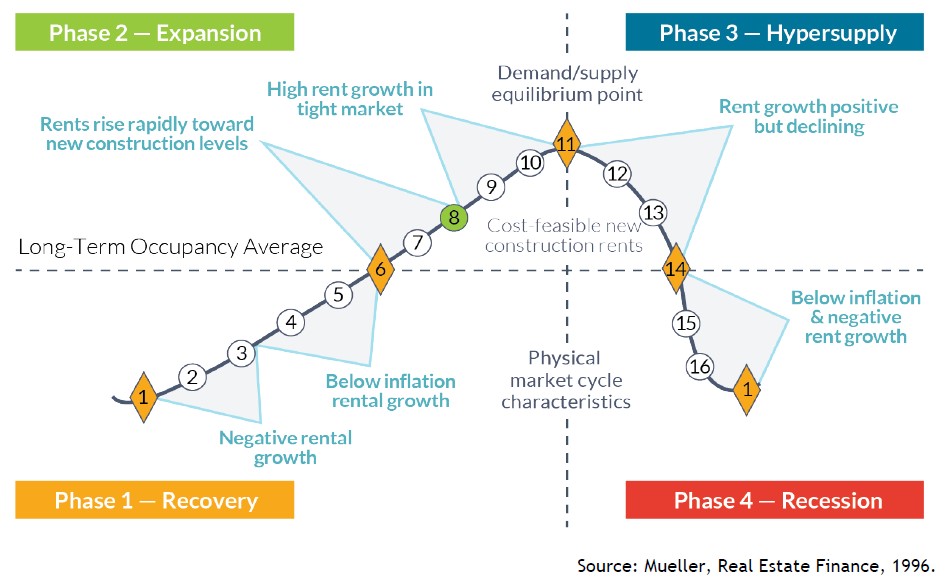

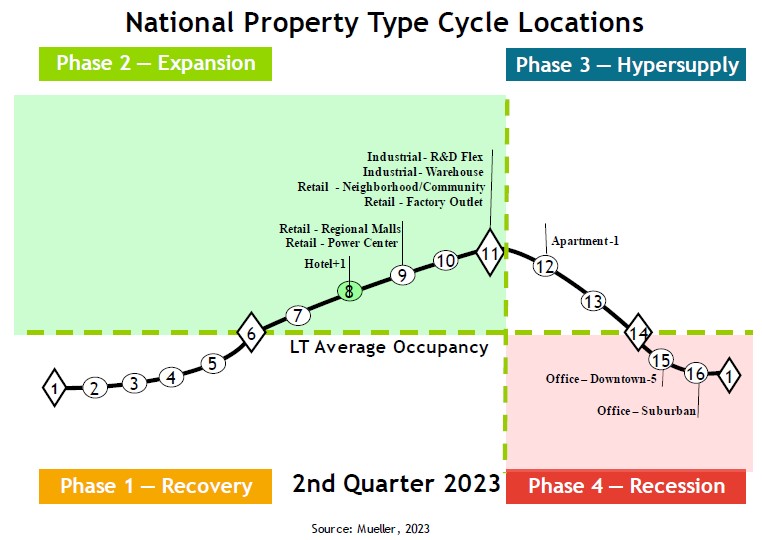

Dr. Glenn Mueller’s quarterly Commercial Real Estate Cycles report gives an overview on what is going on in commercial real estate across the country with specifics for 54 metros including Apartments, Industrial, Office, Retail, and Hotel properties. Dr. Mueller defines four distinct phases in the commercial real estate cycle providing decision points for investment and exit strategies. Long-term occupancy average is the key determinant of rental growth rates and ultimately property values. Ideally, Phase 2 – Expansion is the best quadrant for real estate investor performance as shown in the following graphs and discussion. Most graphs in this summary are taken directly from Dr. Mueller’s Q2 2023 report and are copyrighted.

Across the cycle, Dr. Mueller describes rental behavior within each of the phases, using Market Levels ranging from 1 to 16. Equilibrium occurs at Market Level 11 in which demand growth equals supply growth—literally the sweet spot. The equilibrium Market Level 11 is also the peak occupancy level.

Phase 1 – Recovery Declining Vacancy, No New Construction

1–3 Negative Rental Growth

4–6 Below-Inflation Rental Growth

Phase 2 – Expansion Declining Vacancy, New Construction

6–8 Rents Rise Rapidly Toward New Construction Levels

8–11 High Rent Growth in Tight Market

Phase 3 – Hypersupply Increasing Vacancy, New Construction

11–14 Rent Growth Positive but Declining

Phase 4 – Recession Increasing Vacancy, More Completions

14–16, then back to 1 Below-Inflation, Negative Rent Growth

Rent Growth across the cycle is characterized as follows:

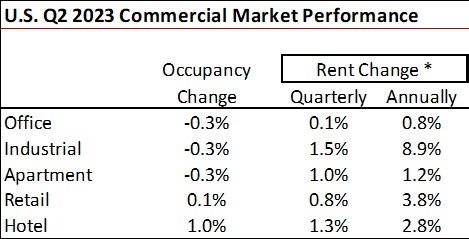

Rents and occupancy changes for Q2 2023, as reported by Mueller, are detailed for the U.S. in aggregate in the table. Industrial properties posted the largest annual rent gain, up 8.9 percent year-over-year followed by retail at 3.8 percent. The 0.8 percent annual rent gain for offices followed massive declines since the onset of the pandemic, indicating the market may be nearing a trough along with a move by tenants as leases renew to more upscale, higher-rent properties.

Dr. Mueller’s Q2 2023 report shows the current cycle stage from a national perspective across property types. The ideal rating is Phase 2 – Expansion and Market Level 11.

Industrial – R&D Flex, Industrial – Warehouse, Retail – Neighborhood/Community, Retail – Factory Outlet, Retail – Regional Malls & Power Centers, and Hotel property types were in Phase 2 – Expansion in Q2 2023 for the U.S.

Property types at peak performance Market Level 11 included: Industrial – R&D Flex, Industrial – Warehouse, Retail – Neighborhood/Community (think grocery stores), and Retail – Factory Outlet.

Office – Downtown and Office – Suburban were relegated to Phase 4 – Recession. Apartments were in Phase 3 – Hypersupply.

On the graph, the number following the metro name indicates how many Market Levels the metro changed from the prior quarter. Hotels, for example, moved from Market Level 7 in Q1 2023 to Market Level 8 as of Q2 2023, indicating an improvement.

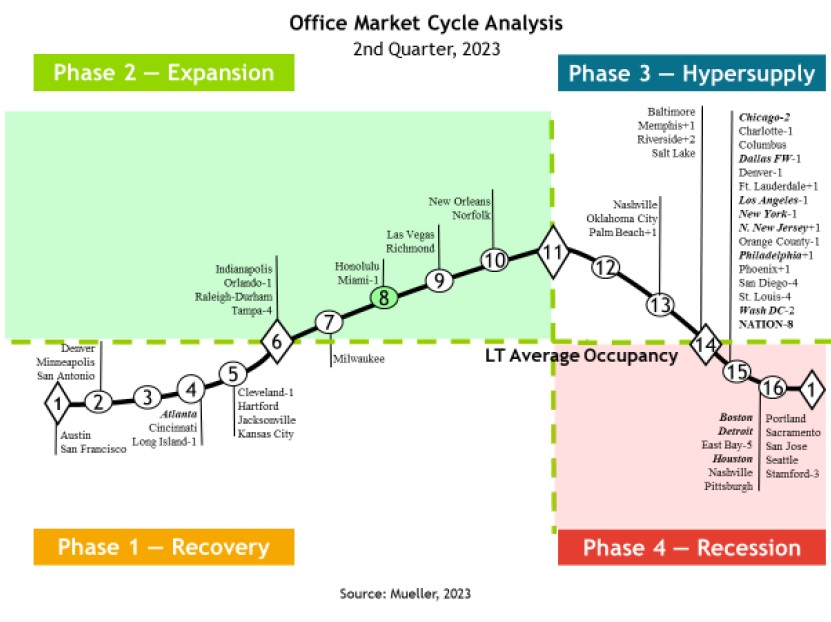

The summary for Office properties for Q2 2023 is shown in the next graph for 54 individual metros across the country. [Download the report for all other property types – link is below.] Only six metros remained at the optimum Phase 2 – Expansion as of Q2 2023 characterized with declining vacancy rates and new construction. The number following the metro name is the Market Level.

New Orleans 10

Norfolk 10

Las Vegas 9

Richmond 9

Honolulu 8

Miami 8

Four metros were on the line between Phase 1 – Recovery and Phase 2 – Expansion:

Indianapolis 6

Orlando 6

Raleigh–Durham 6

Tampa 6

Phase 1 – Recovery (Declining Vacancy and No New Construction) included the following metros:

Cleveland 5

Hartford 5

Jacksonville 5

Kansas City 5

Atlanta 4

Cincinnati 4

Long Island 4

Denver 2

Minneapolis 2

San Antonio 2

Austin 1

San Francisco 1

Three metro office markets were at Phase 3 – Hypersupply, characterized with increasing vacancy rates and more new construction:

Nashville 13

Oklahoma City 13

Palm Beach 13

Three metros were on the line between Phase 3 – Hypersupply and Phase 4 – Recession:

Baltimore 14

Memphis 14

Riverside 14

Salt Lake City 14

All the remaining metros (26) and the country as a whole are now in Phase 4 – Recession with increasing vacancy rates and still more completions coming on the market.

Pay attention to each of the property types in the report focusing on cities that have excess supply, and also those with supply trailing demand.

For the Q2 2023 report that includes Apartments, Industrial, Offices, Retail, and Hotels click Cycle-Monitor-23Q2.pdf.

To download current and historical quarterly reports click daniels.du.edu/burns-school and scroll down to the REAL ESTATE MARKET CYCLE REPORT section on the website.

To learn more about Dr. Glenn Mueller click daniels.du.edu/directory/glenn-mueller.

For commercial real estate practitioners, Dr. Mueller’s report is essential reading quarterly. Again, thanks to Glenn for exceptional cutting-edge commercial research. This is one of the best, data-dense analyses on commercial real estate across the U.S.

Ted