Slower Interest Rate Decline Expectations Yield Slowed Housing Sales

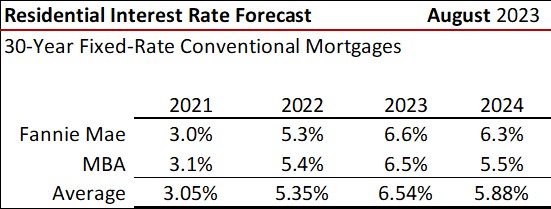

Residential mortgage rates are the needle of the compass pointing to where home sales and residential lending are heading. Residential mortgage rate expectations again rose slightly in the August 2023 forecasts from Fannie Mae and the MBA.

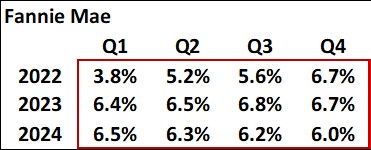

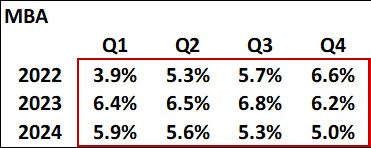

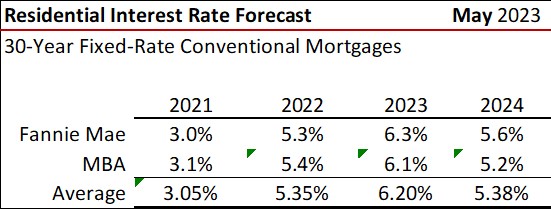

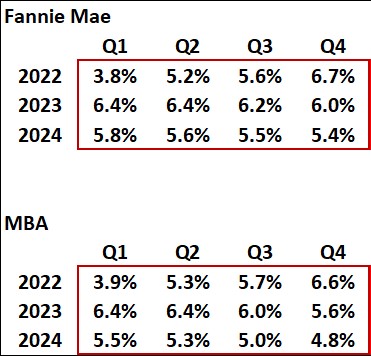

The first set of tables show 30-year conventional mortgage rate expectations as of August 2023 while the second set details forecasts from May this year. The MBA continues to expect lower rates sooner than Fannie Mae, but neither sees rates (on a quarterly average) slipping out of the 6 percent range until at least Q1 next year (MBA), with Fannie forecasting rates remaining in the 6 percent range at least through 2024. On an annual basis, Fannie Mae expectations are 80 basis points greater than the MBA on average in 2024, up from an estimated 60 basis point spread one month ago.

August 2023

May 2023

Historical conventional 30-year fixed-rate mortgage rates are shown in the following graph as reported by Freddie Mac in their weekly Primary Mortgage Market Survey (PMMS). The latest rate as of the week ending August 2023 was 7.23 percent – the highest level in 30-year rates seen since May 2001. Daily rates from other sources continue to be quoted in the mid- to upper-7 percent range.

Existing Home Sales

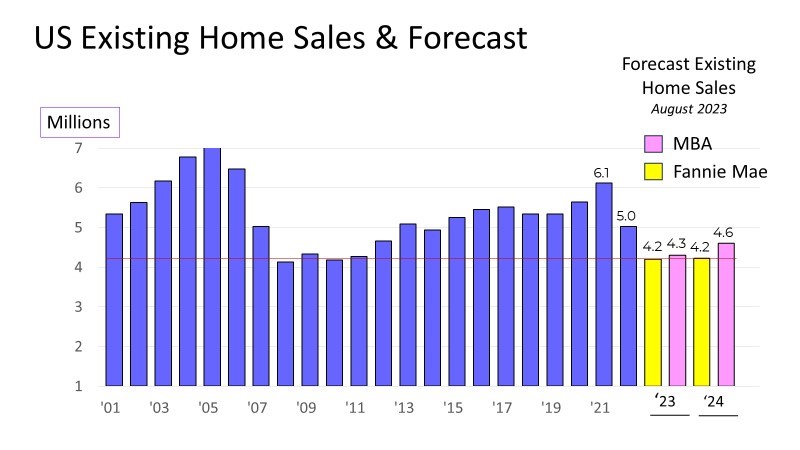

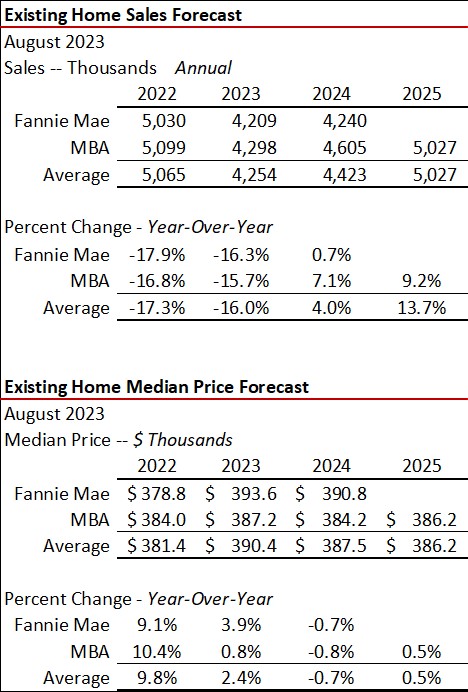

Historical existing annual home sales from 2001 through 2022 are detailed in the next graph. The current estimates for 2023 would be the fewest home sales in the past 13 years, with a slight improvement seen only by the MBA in 2024 due to their assumption of lower residential mortgage rates at that time.

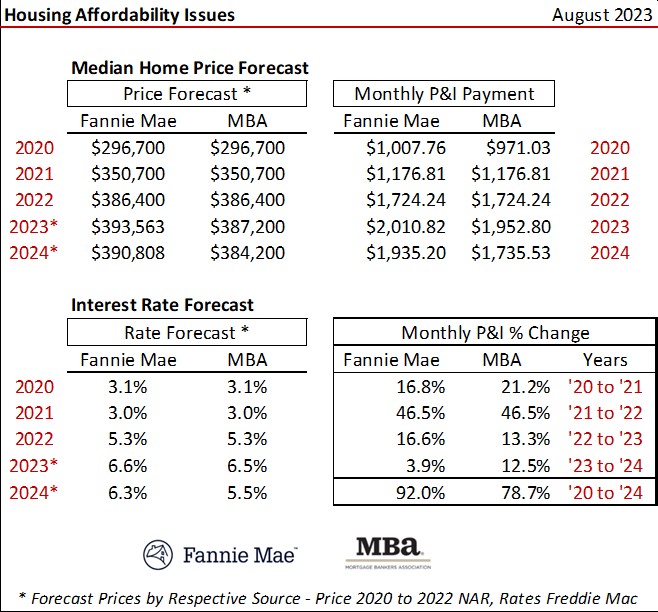

Median prices are expected to essentially remain flat in 2024 and 2025 as of the latest forecasts, though only MBA includes 2025 at this time. Fannie Mae typically expands their forecast each October.

New Home Sales

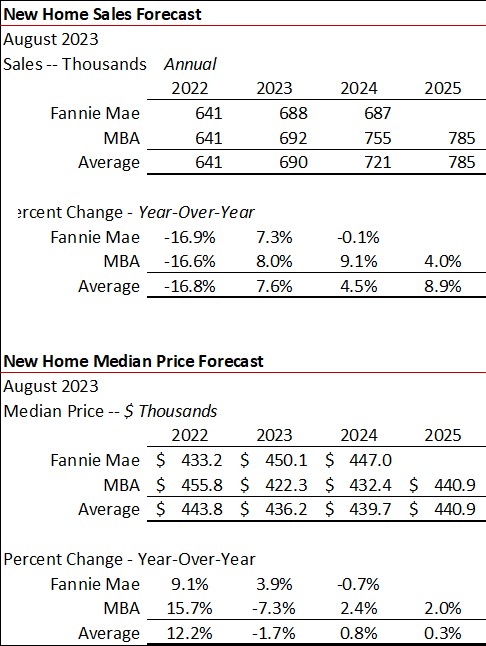

Since 2002, there has been an average one new home sale for every 8.82 existing home closings. The latest forecast from Fannie Mae calls for new home sales to be flat in 2023 and down 3.6 percent in 2024. Based on a lower interest forecast for 2023 and 2024, the MBA sees improved new home sales in 2023 and 2024, up 4.5 percent and 8.9 percent, respectively.

Note that existing home sales and new home sales are counted differently. An existing home sale is counted when the property closes and ownership transfers from one party to another—as tracked and reported by the National Association of Realtors®. New home sales are reported by the U.S. Census Bureau and are counted when a new-home purchase contract is signed, not when the ownership is transferred and all parties are compensated. In many circumstances, a new home sale may not even yet have had a building permit issued. As a result, new home sales are subject to frequent and sometimes material revisions as time passes.

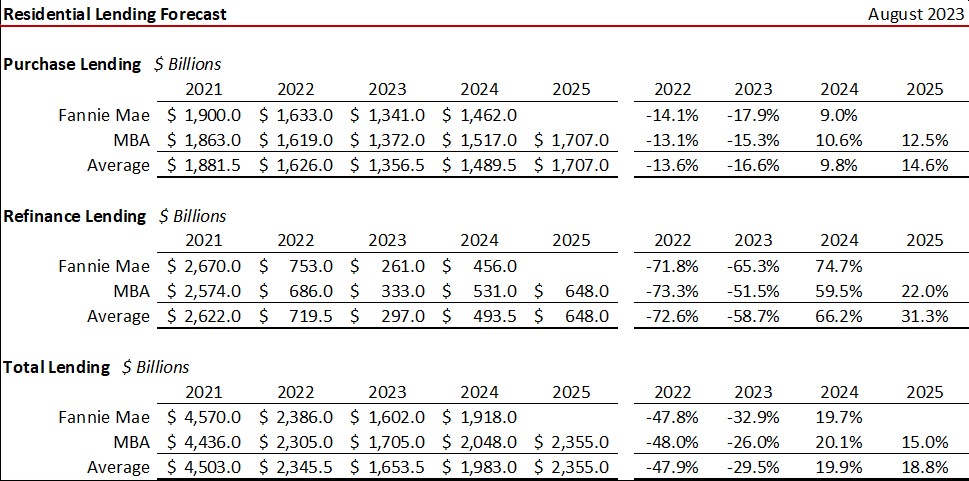

Residential Lending

Rising interest rates crushed refinance activity in 2022 compared to 2021 (down almost 73 percent) with another 50+ percent freefall (average) expected in 2023. More than six in ten residential mortgage lending officers in business in 2021 are now out of a job in the mortgage industry. When the smoke from this implosion clears, for every 10 residential loan officers in business in 2021, there will likely be just three at the end of 2023.

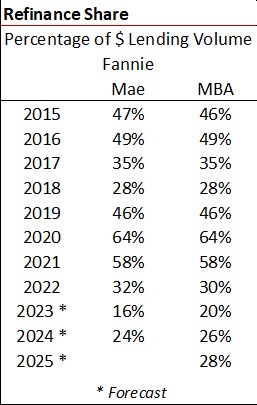

Refinance Share of Residential Lending

Just as with interest rates, Fannie Mae and the MBA diverge on the refinance share of total residential mortgage lending. Estimated historical and forecast refinance shares are shown in the next table.

Estimated Mortgage Payments

The last table shows the typical monthly mortgage payment based on respective MBA and Fannie Mae forecasts (annual average) assuming 20 percent down. The impact of rising rates and median home prices will have seen monthly payments forecast to have rocketed up a range of 78.7 percent (MBA forecast) to 92.0 percent (Fannie Mae) from 2020 to 2024.

Just follow the interest rate compass to see where housing and lending markets are heading. Both home purchasing volumes and refinance activity levels will hinge on where interest rates trend.

Ted