Pandemic-Driven Existing Home Sales Surge Continues -- Home Sales Up 25.8 Percent Year-Over-Year in November 2020

The surge in existing home sales continued, up 25.8 percent in November 2020 versus one-year ago on a seasonally adjusted annualized rate (SAAR) to 6.69 million as reported by the National Association of Realtors® (NAR). Though down 2.5 percent from the October SAAR, much of that is due to the decline in inventory of homes available for sale, with the number of listings down to a record-low 2.3 months of inventory.

On an unadjusted monthly basis, November sales of 492,000 were up 21.8 percent, with total sales in the prior 12-months up 4.8 percent at 5.539 million closings. This was the best November since 2005 when November sales hit 530,000.

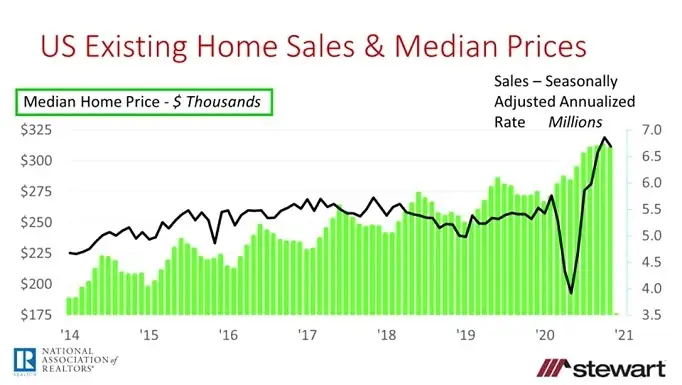

The median price at $310,800 was up 14.6 percent on a year-over-year basis and the average price of $343,000 up 11.3 percent. The next two graphs both show the median price, with the first including sales on a SAAR and the second using trailing 12-month totals.

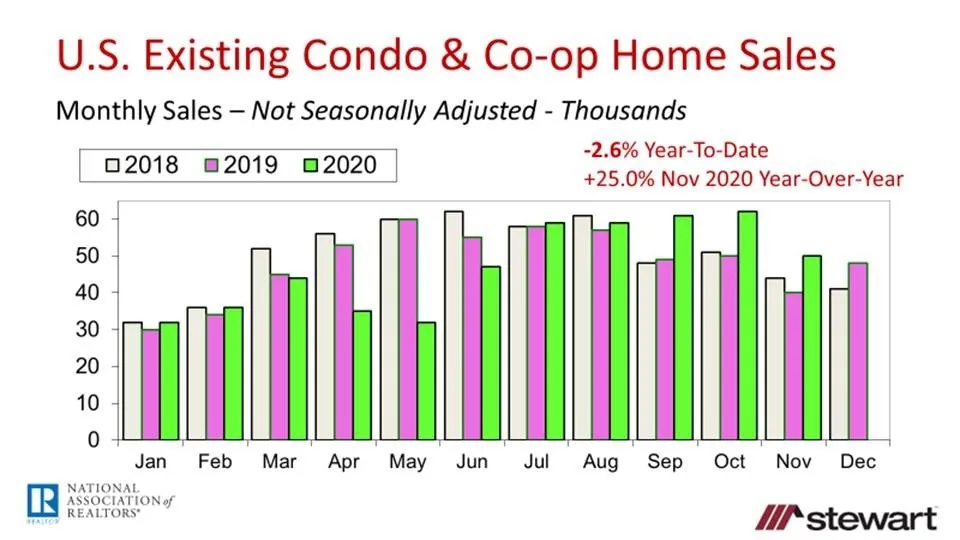

The next three graphs detail monthly sales commencing January 2018. The first contains total sales of single family and condominium-co-op sales summed, the second just single family and the third condominium co-op transactions. Each graph includes year-to-date and year-over-year percentage changes.

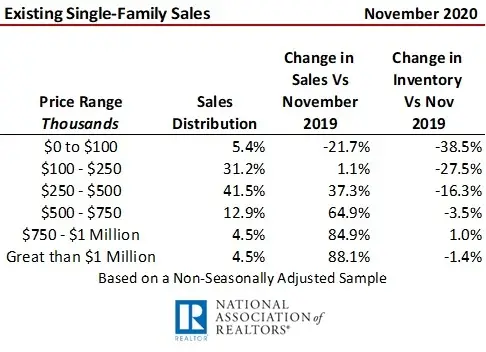

Sales by price range reveal that the hot-housing market continued across all but the lowest price range. NAR conducts a monthly sample (not seasonally adjusted) regarding the percentage change in single-family sales and inventory from one year ago, and distribution of sales by price range. The following table shows these metrics on a national basis for November 2020. Inventory declined or essentially remained flat in every price range on a year-over-year basis. Sales rose in all price ranges from $100,000 and up. Shrinking inventory -- down 38.5 percent versus a year ago -- contributed to the drop in sales in the $100,000 and less segment. The greatest year-over-year increase in sales once again was in the $1 million plus range, almost doubling compared to a year ago (up 88.1 percent), with the $750,000 to $1 million segment up 84.9 percent and home sales from $500,000 to $750,000 up 64.9 percent.

Other details in NAR’s press release included:

- One-in-five closings (20 percent) were all-cash transactions with no mortgage utilized to acquire the property -- identical to a year ago

- Inventory of homes available for sale dropped 9.9 percent from October to 1.28 million dwellings and was down 22 percent versus a year ago

- 6-months of inventory is considered normal, with the record-low 2.3 months inventory defining housing as a Seller’s Market given strong demand and minimal listings

- Median home prices have risen 105 consecutive months on a year-over-year basis

- 1 st -Time buyers bought 32 percent of all November existing home sales, unchanged from one-year ago

- Not even 1 percent of November closings were distressed sales – foreclosures & short sales -- less than one-half the 2 percent rate a year ago

- The typical house was listed for sale just 21 days prior to receiving a written offer in November, down from 38 days in November 2019

- Investors acquired one-in-seven homes sold in November (14 percent) down slightly from 16 percent a year ago

To read the entire NAR press release and access housing sales data use the following links:

While the pandemic has given housing the greatest intrinsic value in our lifetimes due on the amount of time we have spent at home, record-low interest rates helped fuel this demand. The surge in home sales indicates that people in the homebuying segment have not been hit as hard with unemployment. Just 2.8 million homes with mortgages were in a forbearance program with their lender, making up 5.3 percent of the 53 million properties with mortgage loans according to Black Knight. This is less than the 6.7 percent unemployment rate reported by the U.S. Bureau of Labor Statistics for November 2020.